PEP Weekly Technical Analysis

PepsiCo

Global food & beverage giant (Pepsi, Gatorade, Lays, Doritos)

PEP Technical Analysis Summary

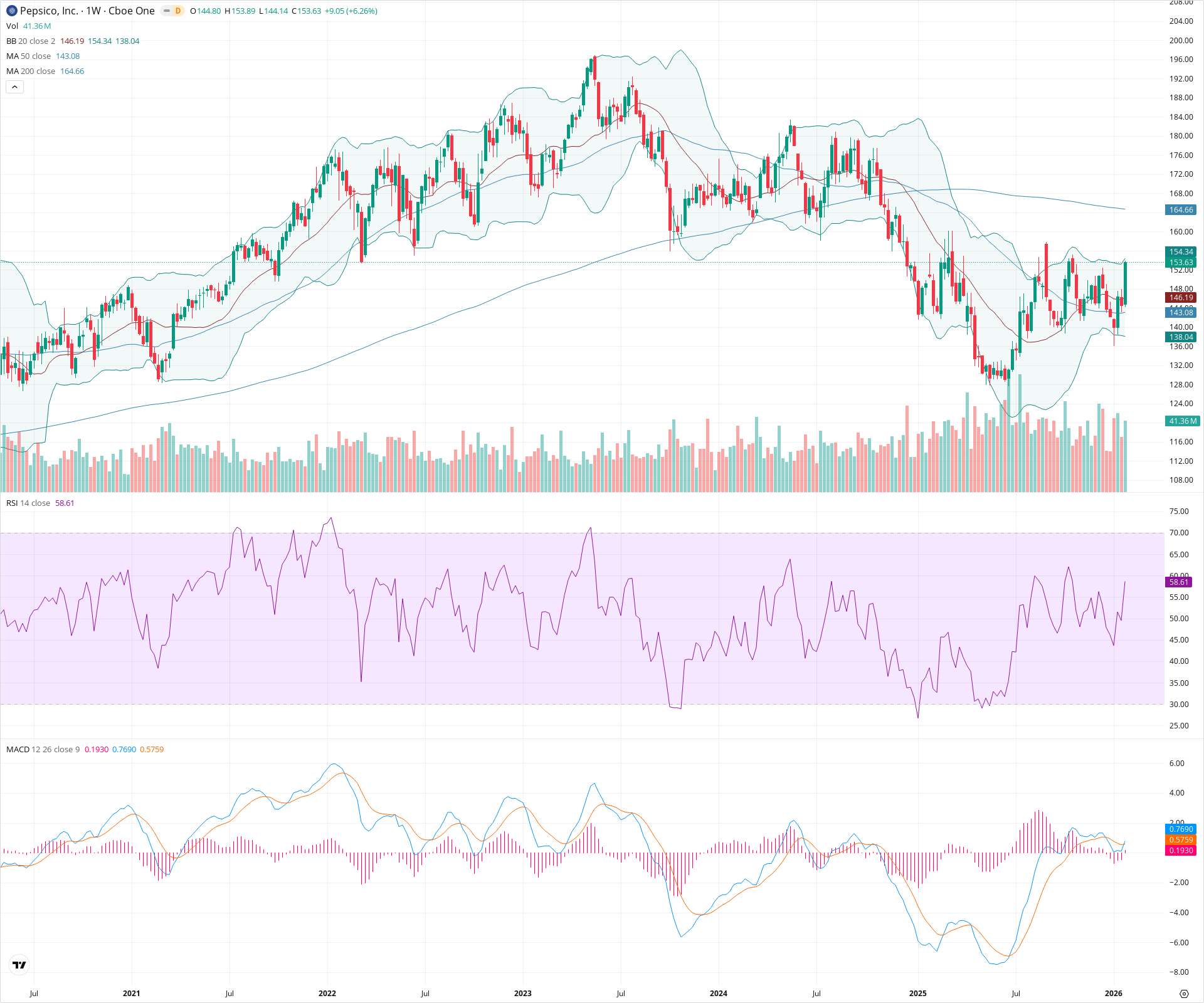

PEP is staging a significant technical recovery on the weekly timeframe, breaking out from a potential inverted head and shoulders reversal pattern. Short-term momentum is strongly positive as price reclaims the 50-week SMA and RSI pushes into bullish territory. However, the long-term trend change will only be confirmed if the price can successfully challenge and overcome the declining 200-week SMA near 165.

Included In Lists

Related Tickers of Interest

PEP Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price has forcefully broken above the 20 and 50-week SMAs with a strong weekly candle closing near the highs. RSI has crossed above 50 indicating gaining momentum, and the MACD has recently executed a bullish crossover.

Long-term Sentiment (weeks to months): Neutral

While the chart shows a constructive bottoming formation, price remains below the declining 200-week SMA (164.66), which defines the primary long-term downtrend.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-01-31T23:32:53.428Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $144.64 | $143.08 - $146.19 | Strong | Confluence of the 50-week SMA and the 20-week SMA (Bollinger Band basis). |

| $137.00 | $136.00 - $138.00 | Strong | Recent higher low forming the right shoulder of a reversal pattern. |

| $129.00 | $128.00 - $130.00 | Strong | Major swing low and structural bottom. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $154.50 | $154.00 - $155.00 | Weak | Immediate resistance at the upper Bollinger Band and current breakout level. |

| $164.50 | $164.00 - $165.00 | Strong | The 200-week SMA is a critical dynamic resistance level. |

| $174.00 | $172.00 - $176.00 | Weak | Previous area of consolidation and breakdown point. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Inverted Head and Shoulders | Bullish | $176.00 | A reversal pattern with the head at ~128, left shoulder at ~136, and right shoulder at ~138. The current price is testing/breaking the neckline. |

Frequently Asked Questions about PEP

What is the current sentiment for PEP?

The short-term sentiment for PEP is currently Bullish because Price has forcefully broken above the 20 and 50-week SMAs with a strong weekly candle closing near the highs. RSI has crossed above 50 indicating gaining momentum, and the MACD has recently executed a bullish crossover.. The long-term trend is classified as Neutral.

What are the key support levels for PEP?

StockDips.AI has identified key support levels for PEP at $144.64 and $137.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is PEP in a significant dip or a Value Dip right now?

PEP has a Value Score of 3/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.