PG Weekly Technical Analysis

Procter & Gamble

Consumer staples leader (Tide, Pampers, Gillette, Olay)

PG Technical Analysis Summary

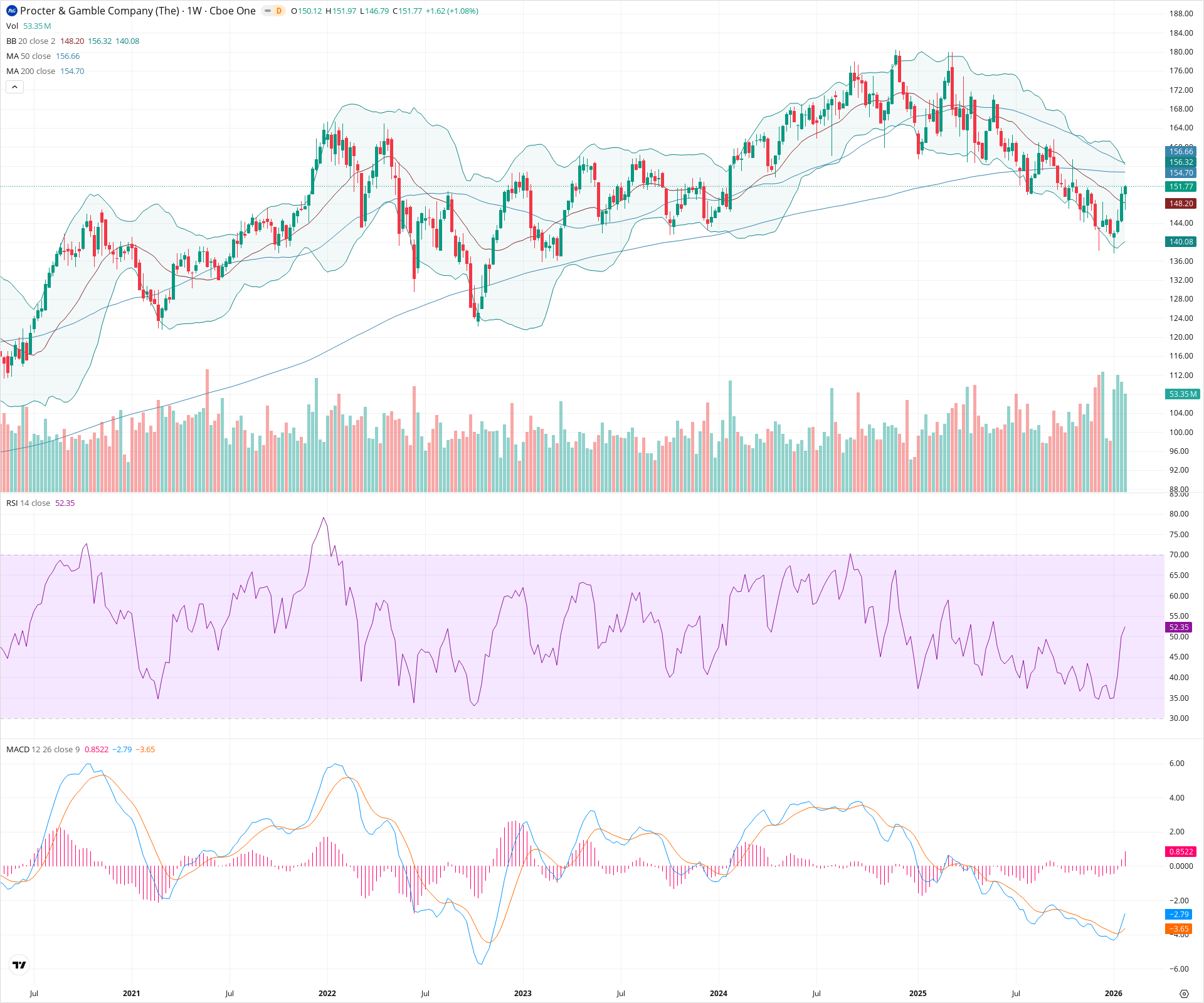

The stock is currently staging a relief rally after finding support near 140, evidenced by improving momentum indicators like the RSI rising past 50 and a MACD bullish crossover. However, the recovery faces a critical test at the 154-157 zone, where the 50 and 200-week SMAs converge to form stiff resistance. A failure to reclaim this level would suggest the longer-term corrective trend remains dominant, while a breakout could signal a resumption of the broader uptrend.

Included In Lists

Related Tickers of Interest

PG Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price has rebounded strongly from recent lows, reclaiming the 20-week SMA; RSI has crossed above 50, and MACD shows a fresh bullish crossover.

Long-term Sentiment (weeks to months): Neutral

While the macro structure maintains higher highs and higher lows relative to 2022, the price is currently trading below the key 50-week and 200-week SMAs, indicating a significant corrective phase.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-01-31T23:32:18.811Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $140.00 | $139.00 - $141.00 | Strong | Recent swing low and reversal point. |

| $125.00 | $122.00 - $128.00 | Strong | Major structural low from 2022. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $155.70 | $154.70 - $156.70 | Strong | Confluence of the 200-week and 50-week SMAs acting as a major overhead barrier. |

| $165.00 | $164.00 - $166.00 | Weak | Previous consolidation zone and swing high area. |

| $177.00 | $176.00 - $178.00 | Strong | Major cycle highs (Double Top area). |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Correction from Double Top | Bearish | N/A | Price formed a double top around the 177 level in 2024/2025 and has since corrected ~20% to find support. |

| Weak | Break and Retest | Neutral | N/A | Price broke below the 150-155 support zone and is now rallying back to retest this zone (now resistance) from below. |

Frequently Asked Questions about PG

What is the current sentiment for PG?

The short-term sentiment for PG is currently Bullish because Price has rebounded strongly from recent lows, reclaiming the 20-week SMA; RSI has crossed above 50, and MACD shows a fresh bullish crossover.. The long-term trend is classified as Neutral.

What are the key support levels for PG?

StockDips.AI has identified key support levels for PG at $140.00 and $125.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is PG in a significant dip or a Value Dip right now?

PG has a Value Score of -11/100. It is currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.