TGT Weekly Technical Analysis

Target Corporation

Large U.S. retail chain offering general merchandise, apparel, home goods, groceries, and essentials through 1,900+ stores and a strong omni-channel platform.

TGT Technical Analysis Summary

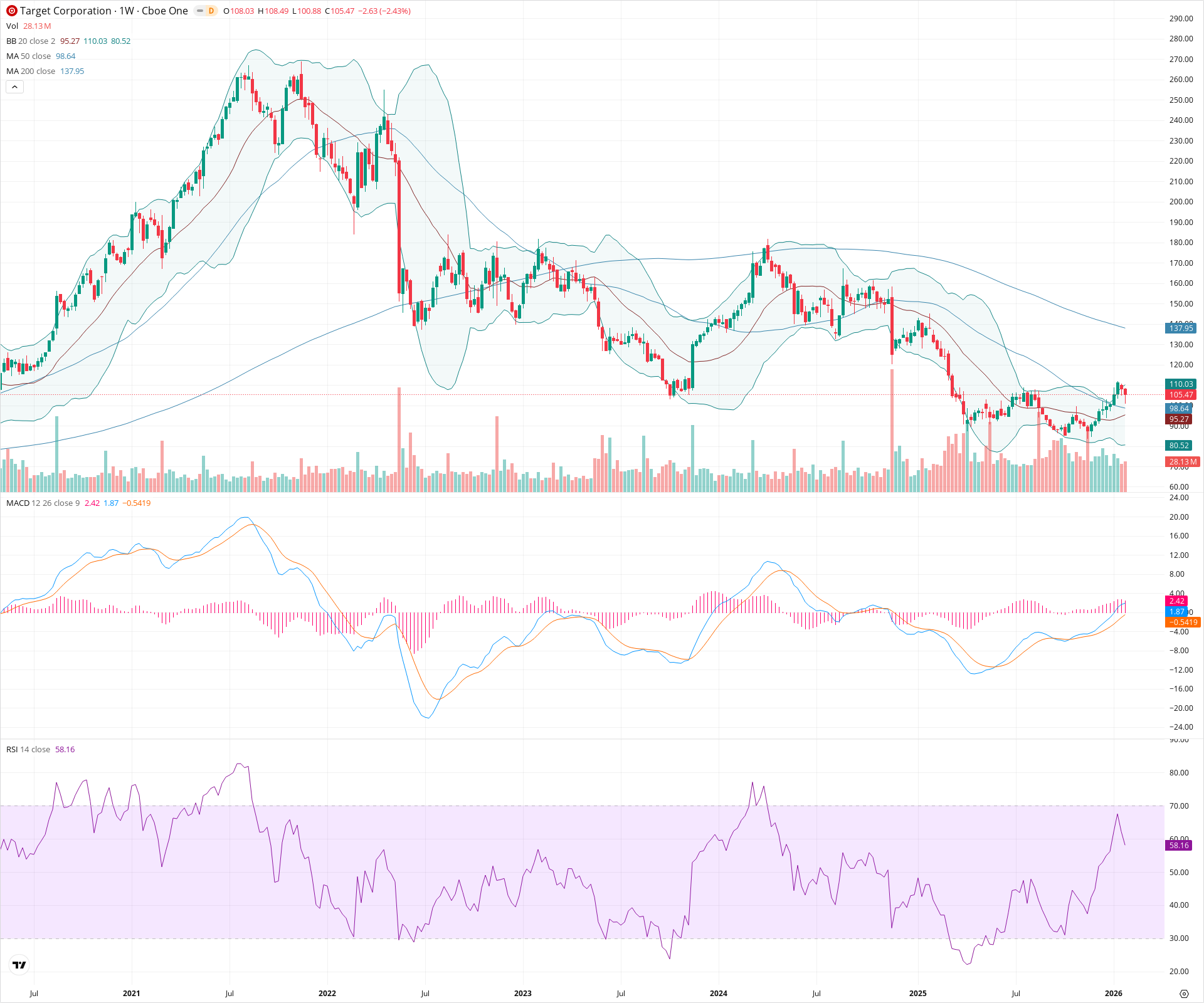

Target (TGT) has suffered a severe technical breakdown, erasing months of gains in a rapid decline to test the critical $100-$105 support zone. The stock is trading below key moving averages with strong bearish momentum, indicated by expanding sell volume and a negative MACD crossover. While the $100 level offers significant historical support that may trigger a stabilization, the overall structure remains vulnerable unless price can reclaim levels above the recent gap at $130.

Included In Lists

Related Tickers of Interest

TGT Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

The stock has experienced a sharp, high-volume decline (gap down) in recent weeks, breaking below intermediate trend structures. Momentum indicators like MACD are negative, and price is closing near the weekly lows.

Long-term Sentiment (weeks to months): Bearish

Price remains below the long-term 200-week SMA and has been rejected firmly at the $180 resistance level. While it is testing major support, the structural trend remains characterized by lower highs compared to the 2021 peak.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-01-31T23:35:10.310Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $102.50 | $100.00 - $105.00 | Strong | Critical multi-year support zone established by the late 2023 lows; currently being tested. |

| $82.50 | $80.00 - $85.00 | Weak | Historical support dating back to pre-2020 consolidation levels. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $131.50 | $128.00 - $135.00 | Strong | Immediate overhead resistance formed by the recent large gap down and breakdown area. |

| $141.50 | $138.00 - $145.00 | Strong | Confluence of the 200-week SMA and previous consolidation zones. |

| $178.00 | $175.00 - $181.00 | Strong | Major swing high and rejection point that capped the 2024 rally. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Range Rejection | Bearish | $100.00 | After rallying to the top of the 100-180 trading range, price was sharply rejected, creating a potential double top or failed recovery formation. |

| Strong | Bearish Gap | Bearish | N/A | A significant weekly gap down indicates aggressive selling pressure and a sudden shift in market sentiment. |

Frequently Asked Questions about TGT

What is the current sentiment for TGT?

The short-term sentiment for TGT is currently Bearish because The stock has experienced a sharp, high-volume decline (gap down) in recent weeks, breaking below intermediate trend structures. Momentum indicators like MACD are negative, and price is closing near the weekly lows.. The long-term trend is classified as Bearish.

What are the key support levels for TGT?

StockDips.AI has identified key support levels for TGT at $102.50 and $82.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is TGT in a significant dip or a Value Dip right now?

TGT has a Value Score of 36/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.