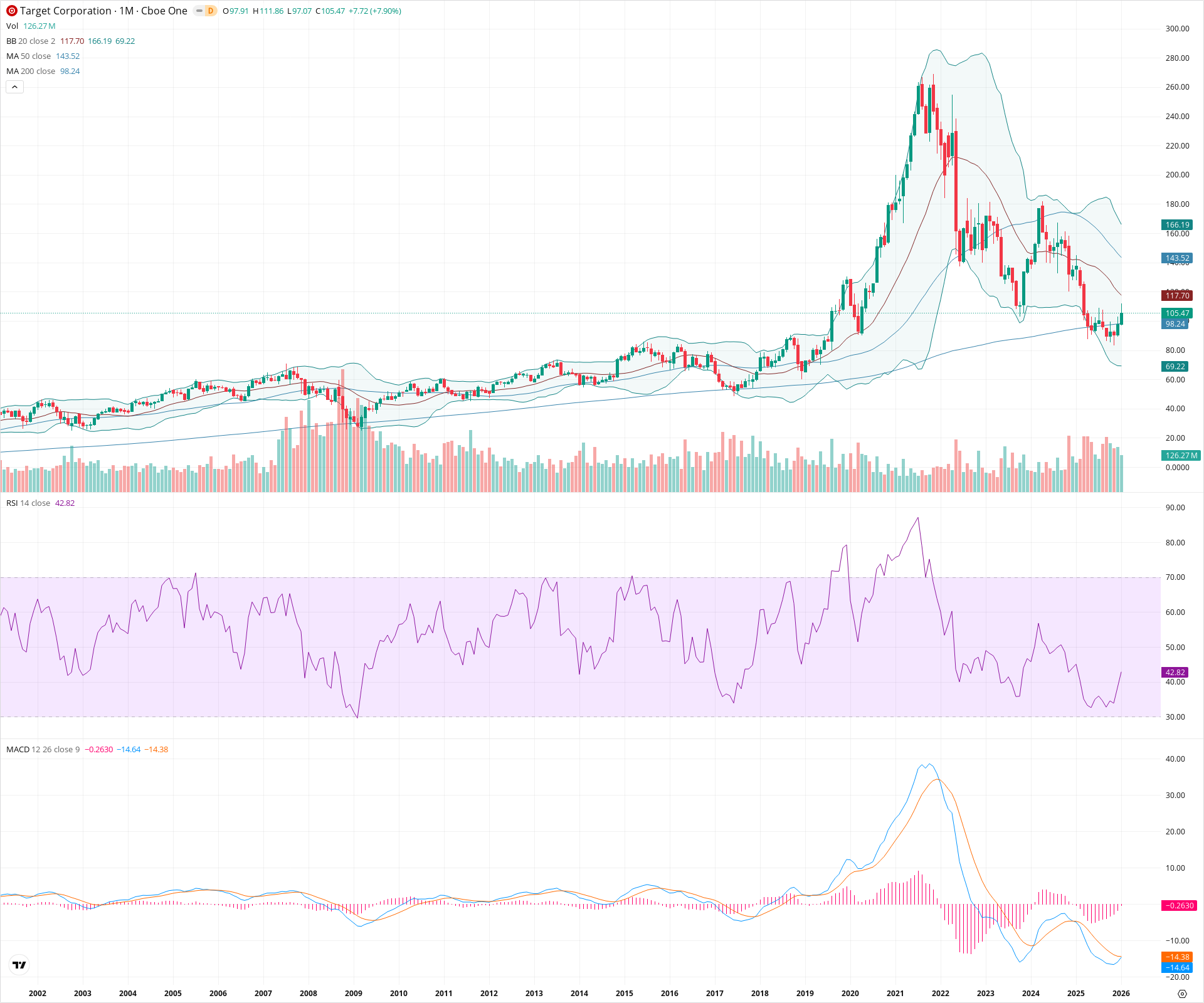

TGT Monthly Technical Analysis

Target Corporation

Large U.S. retail chain offering general merchandise, apparel, home goods, groceries, and essentials through 1,900+ stores and a strong omni-channel platform.

TGT Technical Analysis Summary

Target Corporation is currently navigating a critical test of its secular trend at the 200-month moving average following a severe multi-year correction. While the long-term structure remains bearish with price below the 50-month SMA and momentum indicators in negative territory, the immediate bounce off the 200-month SMA suggests potential stabilization. A sustained move above the 20-month and 50-month SMAs is required to confirm a reversal of the macro downtrend.

Included In Lists

Related Tickers of Interest

TGT Monthly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

The price is showing a strong reaction to the 200-month SMA support level with a significant monthly green candle (+7.90%), suggesting buyers are defending this long-term value zone.

Long-term Sentiment (weeks to months): Bearish

The stock remains in a defined secular downtrend from the 2021 highs, trading below the key 50-month SMA and the middle Bollinger Band. The MACD is deeply negative, confirming a dominant bearish regime despite the recent pause.

Report Metadata

- Timeframe: monthly

- Generated at: 2026-02-02T06:58:35.377Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $97.62 | $97.00 - $98.24 | Strong | Confluence of the 200-month SMA (98.24) and recent monthly lows. |

| $72.00 | $69.00 - $75.00 | Strong | Lower Bollinger Band area and major structural support from pre-2019 consolidation. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $117.50 | $117.00 - $118.00 | Weak | 20-month SMA (Bollinger Band basis) acting as immediate dynamic resistance. |

| $144.00 | $143.00 - $145.00 | Strong | 50-month SMA and a zone of previous price consolidation. |

| $173.00 | $166.00 - $180.00 | Strong | Upper Bollinger Band and major breakdown level from the 2022 decline. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Secular Correction | Bearish | N/A | A multi-year decline from the 2021 all-time highs characterized by lower highs and lower lows. |

| Strong | 200 MA Support Test | Neutral | N/A | Price is currently testing the 200-month Simple Moving Average, a critical secular trend indicator that often defines the long-term floor. |

Frequently Asked Questions about TGT

What is the current sentiment for TGT?

The short-term sentiment for TGT is currently Bullish because The price is showing a strong reaction to the 200-month SMA support level with a significant monthly green candle (+7.90%), suggesting buyers are defending this long-term value zone.. The long-term trend is classified as Bearish.

What are the key support levels for TGT?

StockDips.AI has identified key support levels for TGT at $97.62 and $72.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is TGT in a significant dip or a Value Dip right now?

TGT has a Value Score of 36/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.