COST Monthly Technical Analysis

Costco Wholesale Corp

Membership-based retailer offering bulk goods with strong customer loyalty.

COST Technical Analysis Summary

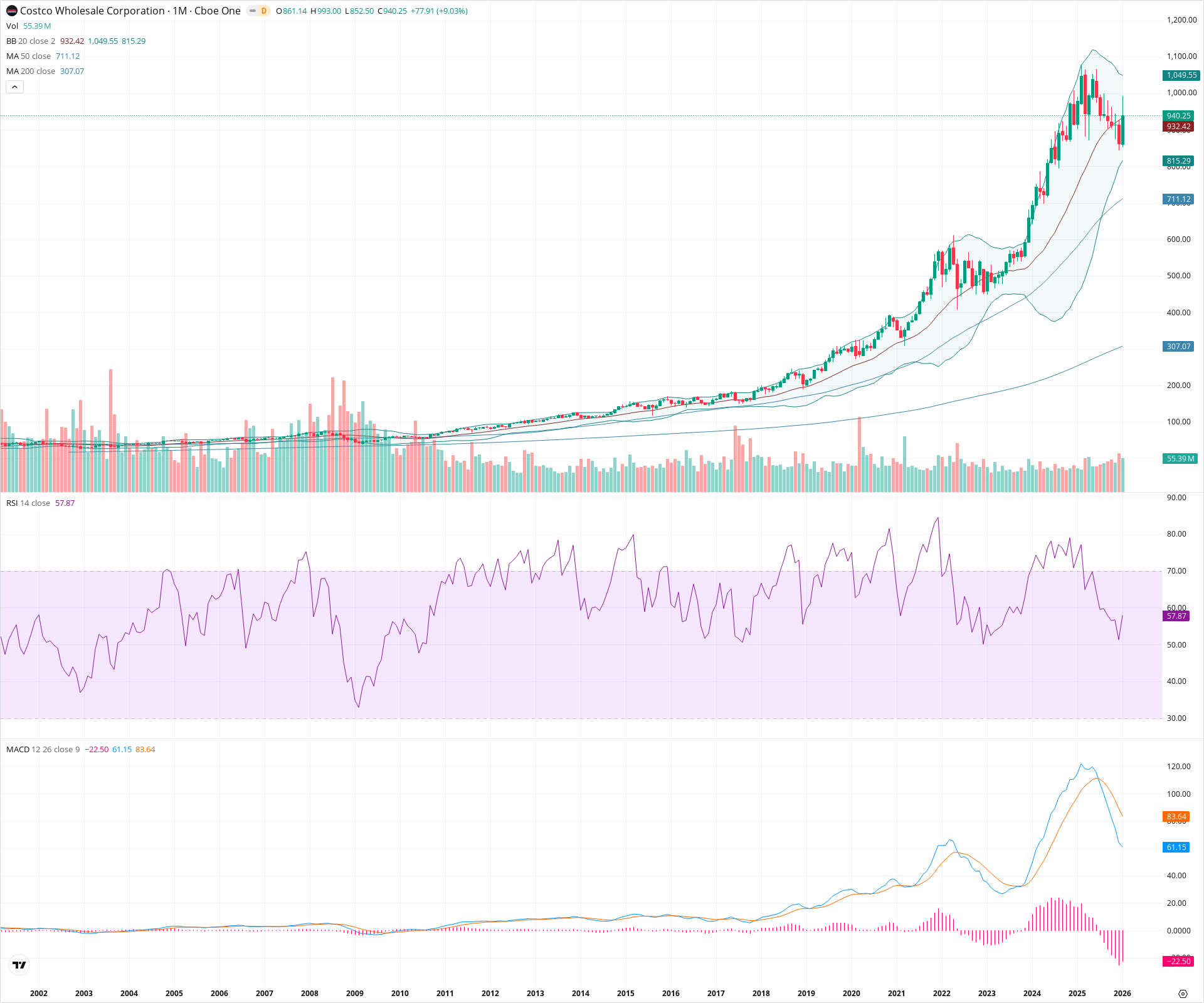

Costco exhibits a robust long-term bullish structure, anchored by a steep ascent well above its 50-month and 200-month moving averages. While the primary trend is undeniably positive, recent indicators such as the bearish MACD crossover and price retraction from the 1000 level suggest a period of monthly consolidation or mean reversion is underway. Investors should watch the 20-month SMA closely as a pivotal dynamic support level.

Included In Lists

Related Tickers of Interest

COST Monthly Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

Price is consolidating after a strong run, currently testing the 20-month SMA as support. A bearish MACD crossover and negative histogram suggest momentum is cooling significantly in the near term.

Long-term Sentiment (weeks to months): Bullish

The stock remains in a definitive secular uptrend, trading well above the rising 50-month and 200-month SMAs. The structural sequence of higher highs and higher lows on the monthly timeframe is intact.

Report Metadata

- Timeframe: monthly

- Generated at: 2026-02-02T05:30:57.269Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $932.50 | $930.00 - $935.00 | Weak | Immediate dynamic support at the 20-month SMA (approx 932.42). |

| $807.50 | $800.00 - $815.00 | Strong | Confluence of the Lower Bollinger Band (815.29) and prior consolidation zone around the 800 psychological level. |

| $707.50 | $700.00 - $715.00 | Strong | Major structural support aligned with the 50-month SMA (711.12). |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $995.00 | $990.00 - $1,000.00 | Strong | Recent all-time high (993.00) and psychological round number. |

| $1,050.00 | $1,045.00 - $1,055.00 | Weak | Upper Bollinger Band projection (approx 1049.55). |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Secular Bull Trend | Bullish | N/A | A persistent multi-year uptrend characterized by parabolic price expansion away from the 50-month SMA. |

| Moderate | Momentum Consolidation | Neutral | N/A | MACD has crossed bearishly below the signal line with a negative histogram, indicating a pause or digestion of the recent parabolic move. |

Frequently Asked Questions about COST

What is the current sentiment for COST?

The short-term sentiment for COST is currently Neutral because Price is consolidating after a strong run, currently testing the 20-month SMA as support. A bearish MACD crossover and negative histogram suggest momentum is cooling significantly in the near term.. The long-term trend is classified as Bullish.

What are the key support levels for COST?

StockDips.AI has identified key support levels for COST at $932.50 and $807.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is COST in a significant dip or a Value Dip right now?

COST has a Value Score of 57/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.