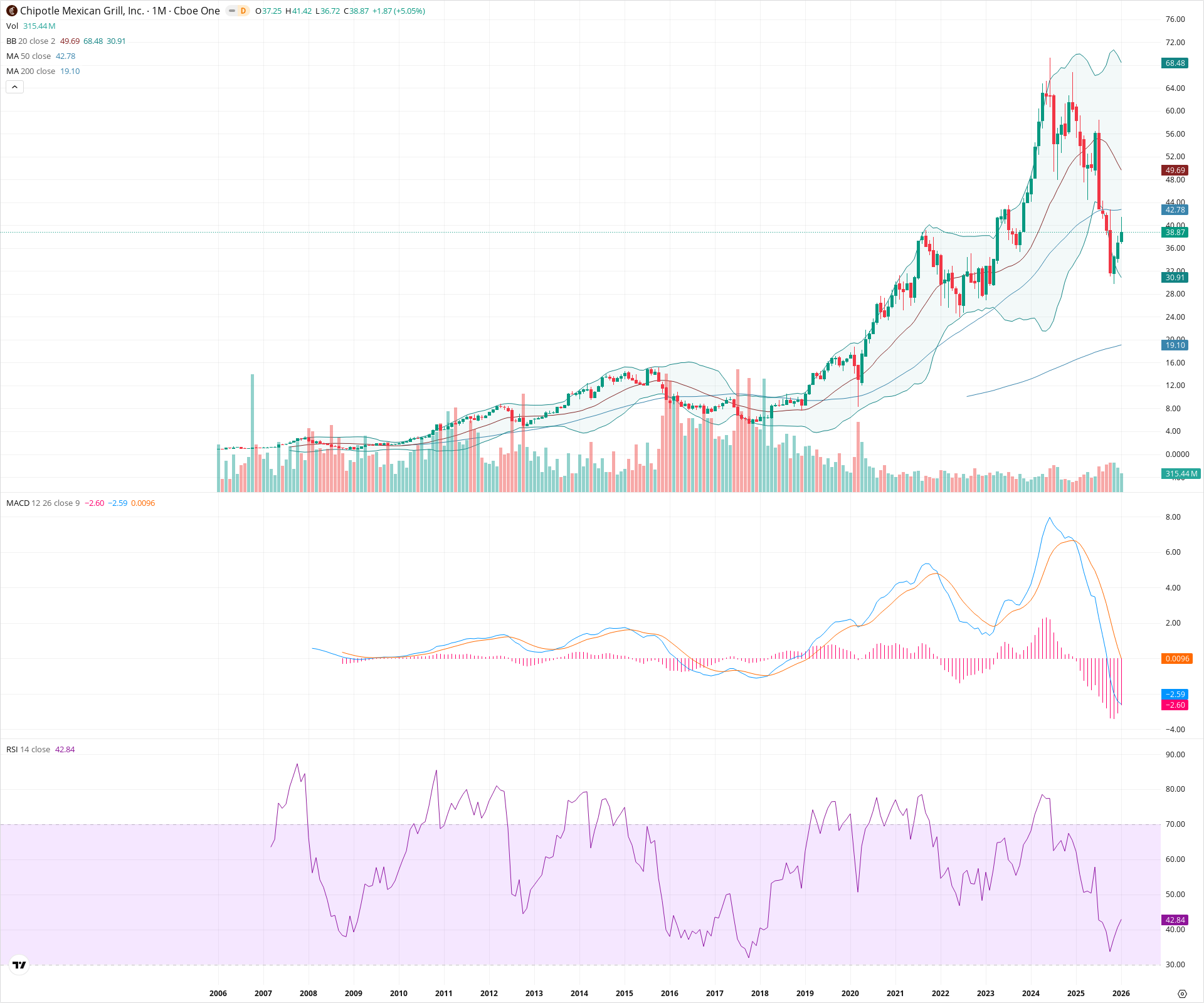

CMG Monthly Technical Analysis

Chipotle Mexican Grill

Fast-casual restaurant chain serving customizable Mexican-inspired meals.

CMG Technical Analysis Summary

CMG is currently in a corrective phase within its long-term history, having retraced significantly from all-time highs and lost support at the 50-month SMA. While short-term indicators show signs of stabilization and a potential momentum shift near the 38.00 level, the overarching structure remains bearish below the 43.00-50.00 resistance zone. Long-term investors should watch for a definitive reclaim of the 50-month SMA or a test of the 200-month SMA for clearer directional cues.

Included In Lists

Related Tickers of Interest

CMG Monthly Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

Price is stabilizing and attempting a bounce, with the MACD histogram turning marginally positive (0.0096), suggesting waning selling momentum. However, the price remains below immediate resistance at the 50-month SMA.

Long-term Sentiment (weeks to months): Bearish

The stock has suffered a deep correction from highs (~68.00), breaking the structural uptrend and trading below the 20-month and 50-month SMAs. The long-term trend is damaged unless these levels are reclaimed.

Report Metadata

- Timeframe: monthly

- Generated at: 2026-02-02T05:30:30.453Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $31.46 | $30.91 - $32.00 | Strong | Coincides with the Lower Bollinger Band and a significant consolidation zone from prior years. |

| $19.55 | $19.10 - $20.00 | Strong | Major secular support at the 200-month SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $43.39 | $42.78 - $44.00 | Strong | 50-month SMA and previous breakdown level serving as immediate overhead resistance. |

| $50.85 | $49.69 - $52.00 | Strong | 20-month SMA (Bollinger Basis) and midpoint of the broader range. |

| $68.50 | $68.00 - $69.00 | Strong | All-time high structural resistance. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Secular Downtrend | Bearish | N/A | A clear series of lower highs and lower lows established from the peak near 68.00, confirming a regime change from the prior bull run. |

Frequently Asked Questions about CMG

What is the current sentiment for CMG?

The short-term sentiment for CMG is currently Neutral because Price is stabilizing and attempting a bounce, with the MACD histogram turning marginally positive (0.0096), suggesting waning selling momentum. However, the price remains below immediate resistance at the 50-month SMA.. The long-term trend is classified as Bearish.

What are the key support levels for CMG?

StockDips.AI has identified key support levels for CMG at $31.46 and $19.55. These levels may represent potential accumulation zones where buying interest could emerge.

Is CMG in a significant dip or a Value Dip right now?

CMG has a Value Score of 49/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.