TXRH Daily Technical Analysis

Texas Roadhouse Inc

Chain of family steakhouses known for hand-cut steaks and casual dining.

TXRH Technical Analysis Summary

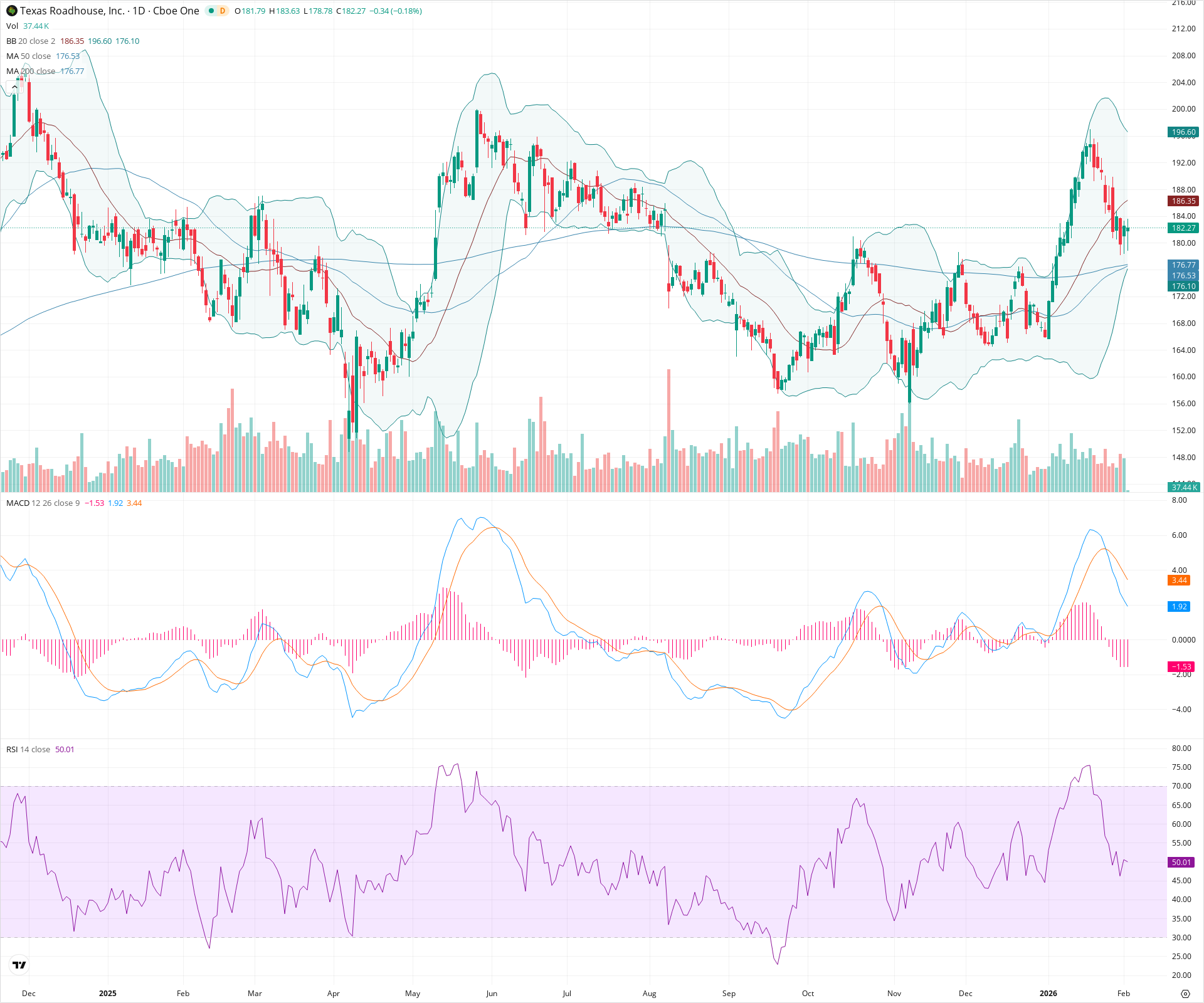

TXRH is currently experiencing a short-term correction, trading below its middle Bollinger Band with bearish momentum indicated by the MACD crossover. However, the stock is approaching a highly significant support cluster around 176-177, formed by the convergence of the 50-day and 200-day moving averages and the lower Bollinger Band. The RSI has reset to neutral (50), suggesting the pullback may be nearing a stabilization point within the context of a broader recovery trend.

Included In Lists

Related Tickers of Interest

TXRH Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

The price has broken below the 20-day SMA basis line, and the MACD shows a confirmed bearish crossover with expanding negative histogram momentum.

Long-term Sentiment (weeks to months): Bullish

Price action remains above both the 50-day and 200-day SMAs, which are converging for a potential Golden Cross, indicating the broader trend from the October lows is still intact.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:15:26.516Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $176.45 | $176.10 - $176.80 | Strong | Critical confluence zone containing the 50-day SMA (176.53), 200-day SMA (176.77), and lower Bollinger Band (176.10). |

| $165.00 | $164.00 - $166.00 | Weak | Previous swing low support established in October. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $187.18 | $186.35 - $188.00 | Weak | Immediate resistance at the 20-day SMA (Bollinger basis) and recent consolidation breakdown level. |

| $199.30 | $196.60 - $202.00 | Strong | Upper Bollinger Band and recent swing highs from January. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bull Flag / Pullback | Bullish | N/A | After a strong rally from October to January, the price is currently retracing in an orderly fashion towards the major moving averages. |

| Strong | Approaching Golden Cross | Bullish | N/A | The 50-day SMA is rising sharply and is fractions of a point away from crossing above the 200-day SMA. |

Frequently Asked Questions about TXRH

What is the current sentiment for TXRH?

The short-term sentiment for TXRH is currently Bearish because The price has broken below the 20-day SMA basis line, and the MACD shows a confirmed bearish crossover with expanding negative histogram momentum.. The long-term trend is classified as Bullish.

What are the key support levels for TXRH?

StockDips.AI has identified key support levels for TXRH at $176.45 and $165.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is TXRH in a significant dip or a Value Dip right now?

TXRH has a Value Score of 46/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.