EEM Daily Technical Analysis

Emerging Markets ETF

iShares MSCI Exchange-Traded Fund designed to track the performance of large- and mid-cap stocks across emerging market countries, including China, Taiwan, India, Brazil, and South Africa. Often used as a macro indicator for global risk appetite and emerging-market sentiment.

EEM Technical Analysis Summary

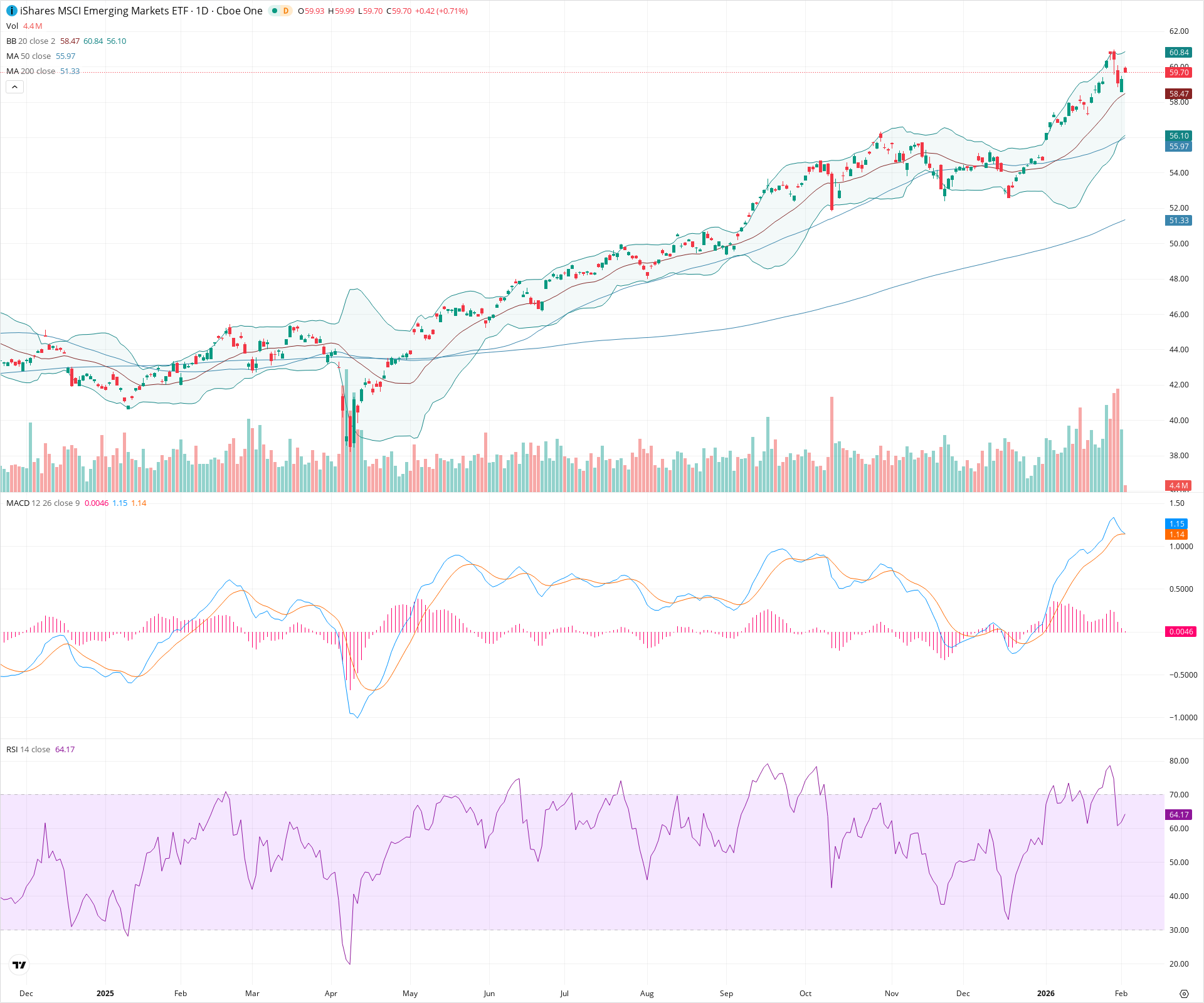

EEM exhibits a robust long-term bullish trend, trading significantly above its rising 50-day and 200-day moving averages. Recently, the asset has entered a short-term consolidation or pullback phase from a high near 62.00, bringing the price down to 59.70 and cooling the RSI from overbought territory. While MACD momentum has flattened, suggesting a temporary pause, the primary trend remains constructive as long as the price maintains support above the mid-50s zone.

Included In Lists

Related Tickers of Interest

EEM Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is in a clear uptrend and holding above the 20-day SMA support (58.47). The recent pullback from highs allows RSI to cool from overbought levels without breaking market structure.

Long-term Sentiment (weeks to months): Bullish

The price is trading well above both the rising 50-day and 200-day SMAs. A 'Golden Cross' alignment is visible, and the long-term trend of higher highs and higher lows remains intact.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:14:04.618Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $58.45 | $58.40 - $58.50 | Weak | Aligns with the 20-day SMA and the middle Bollinger Band basis. |

| $56.00 | $55.90 - $56.10 | Strong | Confluence of the 50-day SMA and the lower Bollinger Band. |

| $51.65 | $51.30 - $52.00 | Strong | Major structural support aligning with the 200-day SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $60.90 | $60.80 - $61.00 | Weak | Dynamic resistance at the Upper Bollinger Band. |

| $62.10 | $62.00 - $62.20 | Strong | The recent swing high and peak of the current trend leg. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Uptrend Channel | Bullish | N/A | A sustained channel of higher highs and higher lows visible throughout the chart duration, supported by rising moving averages. |

| Weak | Bullish Pullback | Bullish | $62.00 | Short-term consolidation phase where price has retreated from ~62.00 to ~59.70, relieving overbought RSI conditions. |

Frequently Asked Questions about EEM

What is the current sentiment for EEM?

The short-term sentiment for EEM is currently Bullish because Price is in a clear uptrend and holding above the 20-day SMA support (58.47). The recent pullback from highs allows RSI to cool from overbought levels without breaking market structure.. The long-term trend is classified as Bullish.

What are the key support levels for EEM?

StockDips.AI has identified key support levels for EEM at $58.45 and $56.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is EEM in a significant dip or a Value Dip right now?

EEM has a Value Score of 72/100. It is currently flagged as a significant dip in the Top Dips list. It is also listed as a Value Dip because long-term sentiment is bullish.

View the full interactive analysis on StockDips.AI.