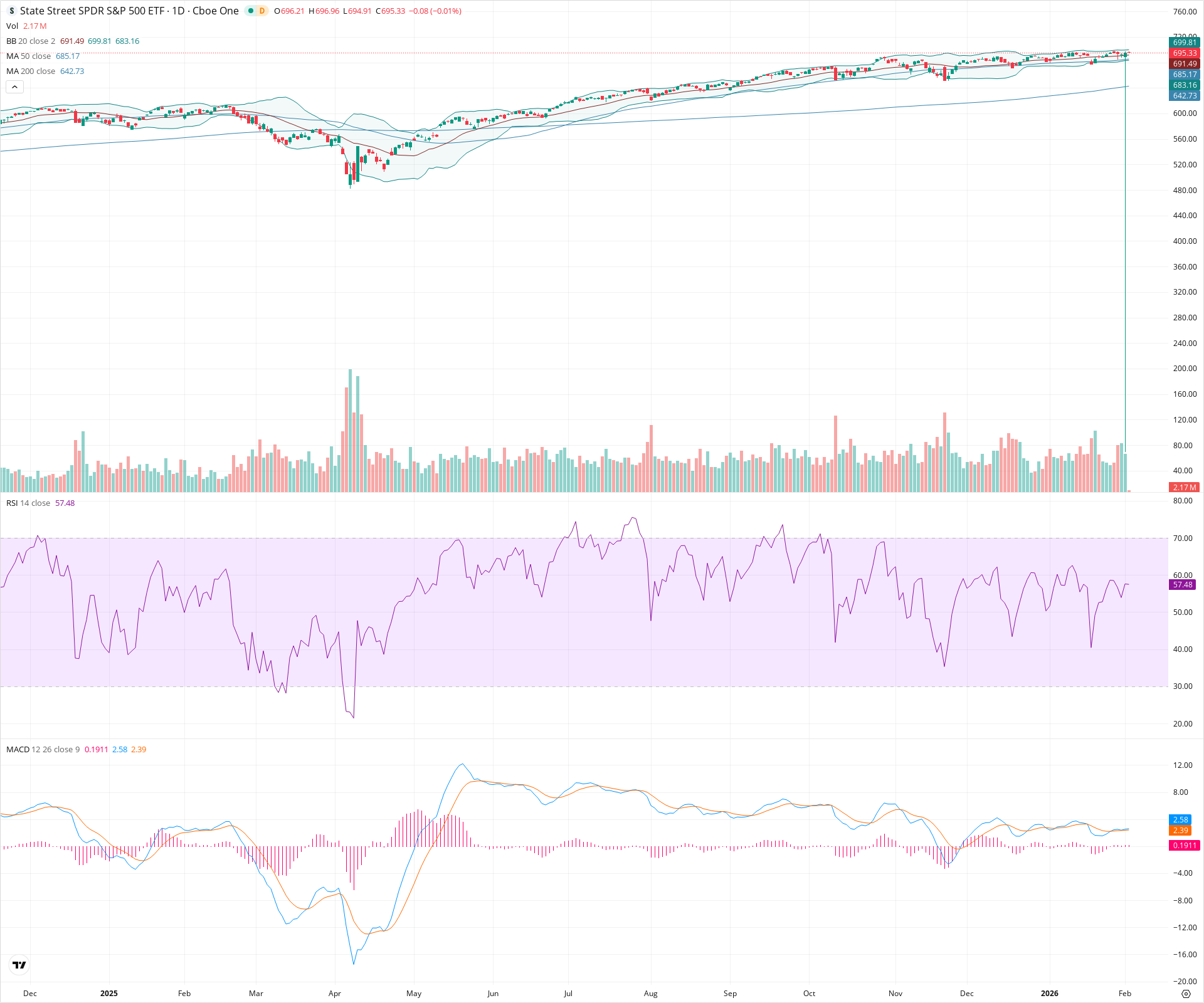

SPY Daily Technical Analysis

S&P 500 Index

SPDR S&P 500 ETF - Tracks the S&P 500 index of the largest U.S. companies and serves as a core benchmark for the U.S. market.

SPY Technical Analysis Summary

The technical outlook for SPY remains strongly bullish on the daily timeframe, supported by a consistent sequence of higher highs and rising moving averages. While momentum has cooled slightly in the short term as indicated by the flattening MACD and neutral-bullish RSI, the price action remains constructive above the 20-day and 50-day SMAs. Investors should watch for a breakout above the 700 psychological level or a pullback to the 685 zone as a potential reentry opportunity.

Included In Lists

Related Tickers of Interest

SPY Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is holding above the rising 20-day SMA and mid-Bollinger Band (691.49). RSI is in bullish territory (above 50) but steady, indicating consolidation within an uptrend rather than a reversal.

Long-term Sentiment (weeks to months): Bullish

The chart exhibits a robust uptrend with a classic bullish alignment of moving averages (Price > 20 > 50 > 200). The 200-day SMA is rising steadily, and the price is well above major trend support.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:01:51.919Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $691.25 | $691.00 - $691.50 | Weak | Immediate dynamic support at the 20-day SMA and Bollinger Band basis. |

| $682.59 | $680.00 - $685.17 | Strong | Confluence of the 50-day SMA and recent consolidation swing lows formed in late January/early February. |

| $646.00 | $642.00 - $650.00 | Strong | Major structural support aligned with the 200-day SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $698.48 | $696.96 - $700.00 | Strong | Current session high and the psychological 700 level, coinciding closely with the Upper Bollinger Band (699.81). |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Ascending Channel | Bullish | N/A | Price has been trending upwards in a defined parallel channel for several months, consistently making higher highs and higher lows. |

| Weak | High Tight Flag | Bullish | N/A | Short-term consolidation near highs following a strong run-up, often a continuation pattern. |

Frequently Asked Questions about SPY

What is the current sentiment for SPY?

The short-term sentiment for SPY is currently Bullish because Price is holding above the rising 20-day SMA and mid-Bollinger Band (691.49). RSI is in bullish territory (above 50) but steady, indicating consolidation within an uptrend rather than a reversal.. The long-term trend is classified as Bullish.

What are the key support levels for SPY?

StockDips.AI has identified key support levels for SPY at $691.25 and $682.59. These levels may represent potential accumulation zones where buying interest could emerge.

Is SPY in a significant dip or a Value Dip right now?

SPY has a Value Score of 110/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.