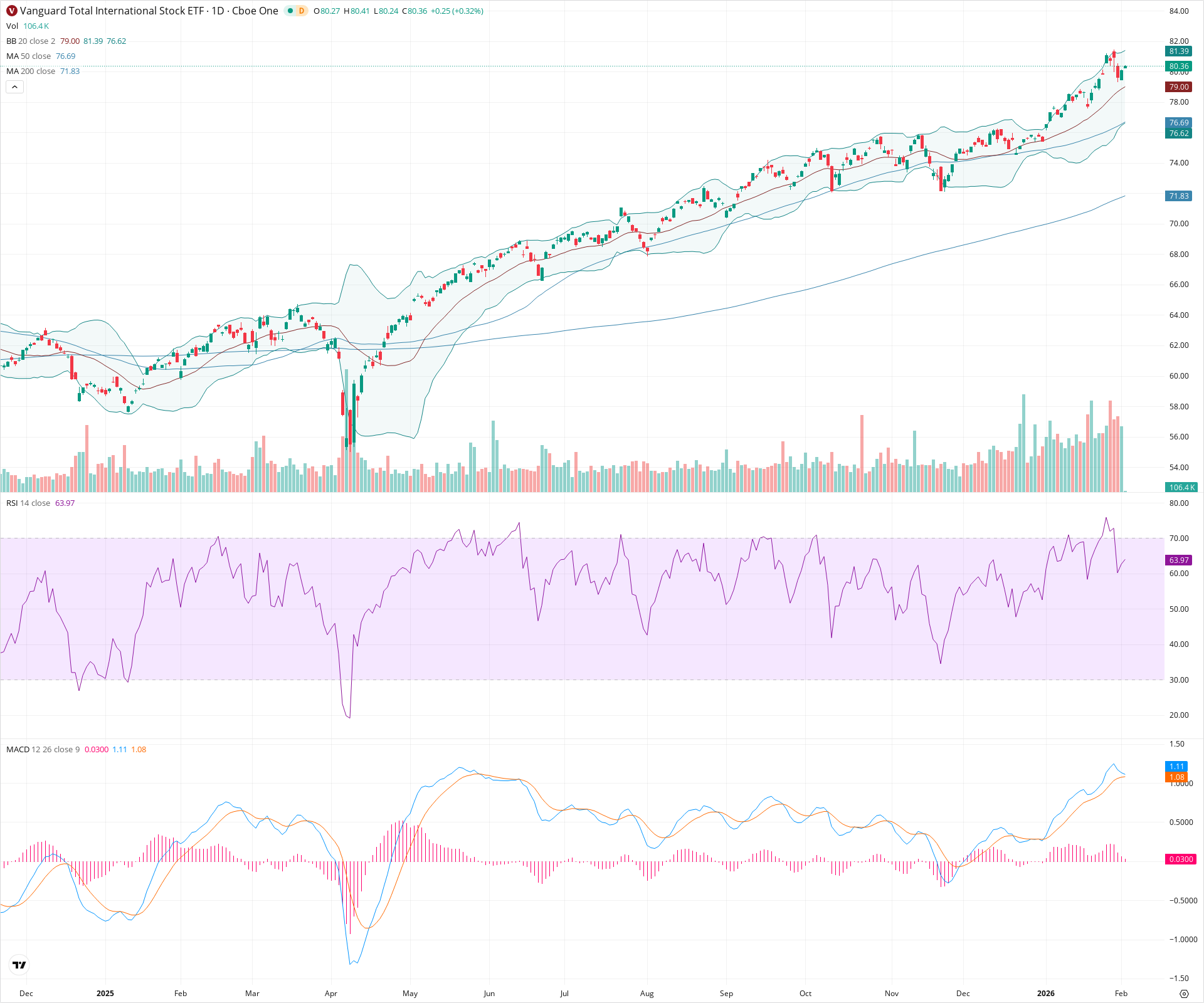

VXUS Daily Technical Analysis

International Stock Index

Vanguard Total International Stock ETF - Covers thousands of companies across developed and emerging markets outside the U.S.

VXUS Technical Analysis Summary

VXUS exhibits a strong technical uptrend characterized by price action consistently above rising key moving averages (50 and 200-day). The recent pullback to the 20-day SMA appears to have found support around 79.00, with the price now curling upward. Momentum indicators like the MACD show some deceleration (narrowing histogram), but the overall structure remains bullish as long as the 50-day SMA holds.

Included In Lists

Related Tickers of Interest

VXUS Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is holding support at the 20-day SMA (79.00) and rebounding, with RSI in a healthy bullish zone (63.97) showing renewed upward momentum.

Long-term Sentiment (weeks to months): Bullish

The stock is in a sustained uptrend, trading well above the rising 50-day and 200-day SMAs with a clear structure of higher highs and higher lows.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:01:51.618Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $78.90 | $78.80 - $79.00 | Strong | Confluence of the 20-day SMA and recent pullback lows. |

| $76.65 | $76.60 - $76.70 | Strong | Aligns with the 50-day SMA which has acted as trend support. |

| $71.90 | $71.80 - $72.00 | Strong | Long-term support at the 200-day SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $81.70 | $81.39 - $82.00 | Strong | Recent swing high combined with the Upper Bollinger Band resistance. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Rising Channel | Bullish | N/A | Price is oscillating within a well-defined parallel uptrend channel, respecting the 20-day and 50-day moving averages. |

| Weak | Bullish Consolidation / Pullback | Bullish | $82.00 | Recent price action shows a healthy retracement to the mean (20-day SMA) followed by a stabilization, typical of trend continuation. |

Frequently Asked Questions about VXUS

What is the current sentiment for VXUS?

The short-term sentiment for VXUS is currently Bullish because Price is holding support at the 20-day SMA (79.00) and rebounding, with RSI in a healthy bullish zone (63.97) showing renewed upward momentum.. The long-term trend is classified as Bullish.

What are the key support levels for VXUS?

StockDips.AI has identified key support levels for VXUS at $78.90 and $76.65. These levels may represent potential accumulation zones where buying interest could emerge.

Is VXUS in a significant dip or a Value Dip right now?

VXUS has a Value Score of 67/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.