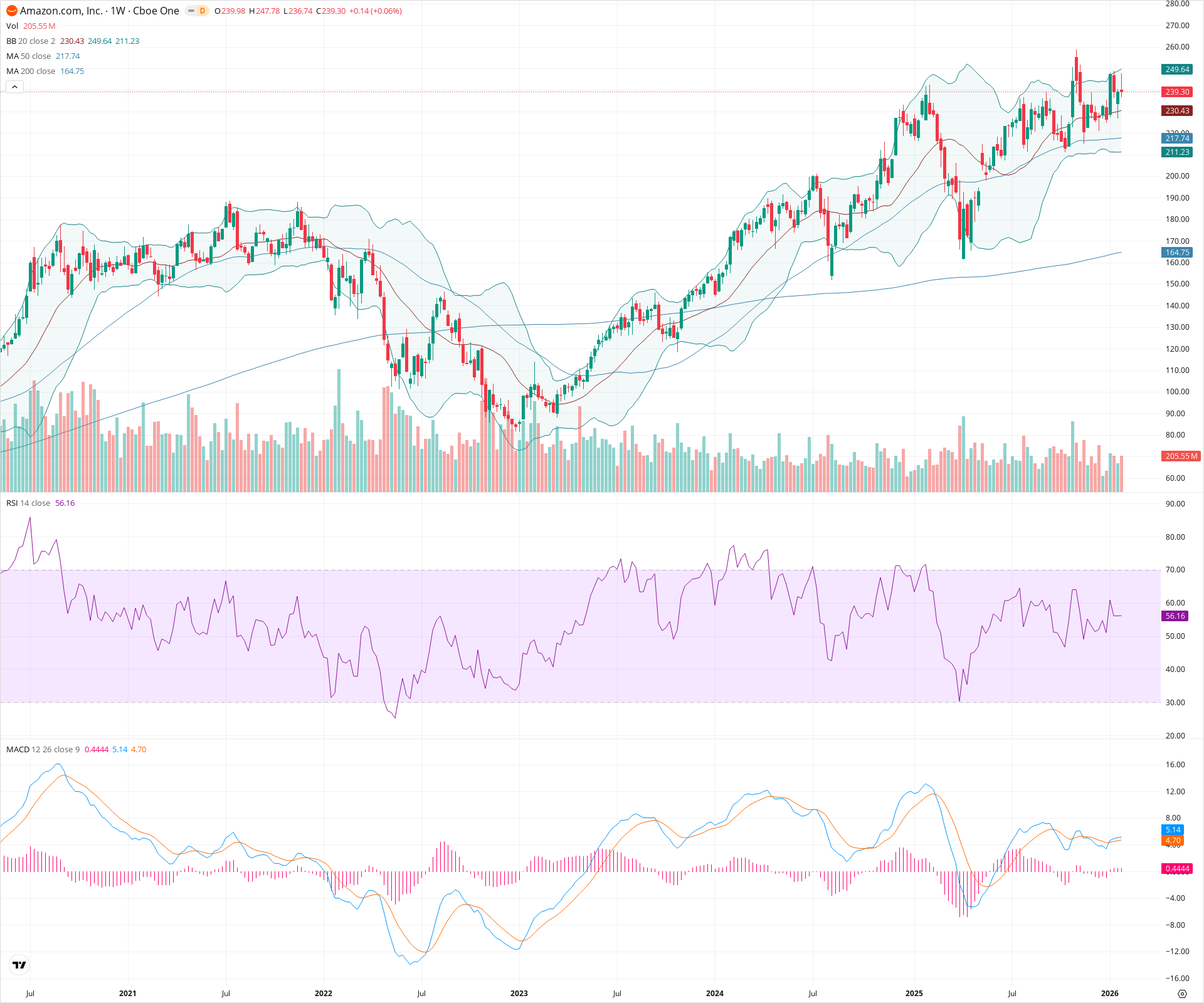

AMZN Weekly Technical Analysis

Amazon.com Inc.

Global e-commerce leader with major cloud services via Amazon Web Services.

AMZN Technical Analysis Summary

AMZN is exhibiting a robust technical structure, characterized by a sustained uptrend and bullish alignment of all major moving averages. The price is currently consolidating near its highs, finding support along the 20-week SMA, while the MACD histogram suggests positive momentum is maintained. Provided the stock holds above the 217 level (50-week SMA), the long-term outlook remains constructive with eyes on a breakout above the 255 resistance zone.

Included In Lists

Related Tickers of Interest

AMZN Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is maintaining position above the 20-week SMA (230.43) and RSI is above 50, showing constructive consolidation after a strong run.

Long-term Sentiment (weeks to months): Bullish

The stock is in a confirmed long-term uptrend with the 50-week SMA well above the rising 200-week SMA, and price holding structurally higher highs.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-01-31T23:28:49.882Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $229.25 | $228.00 - $230.50 | Weak | Immediate dynamic support at the 20-week SMA and middle Bollinger Band. |

| $214.00 | $210.00 - $218.00 | Strong | Major confluence zone containing the 50-week SMA and recent swing lows. |

| $195.00 | $190.00 - $200.00 | Strong | Previous major resistance turned support and psychological round number. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $252.50 | $250.00 - $255.00 | Strong | Recent swing highs and upper Bollinger Band area acting as the primary ceiling. |

| $267.50 | $265.00 - $270.00 | Weak | Trend projection level and psychological extension zone. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bullish Trend Channel | Bullish | N/A | Price has been adhering to a clearly defined upward channel since the 2023 bottom. |

| Weak | High-Level Consolidation | Neutral | $260.00 | Following a rally, the price is moving sideways between 230 and 255, digesting gains above key moving averages. |

Frequently Asked Questions about AMZN

What is the current sentiment for AMZN?

The short-term sentiment for AMZN is currently Bullish because Price is maintaining position above the 20-week SMA (230.43) and RSI is above 50, showing constructive consolidation after a strong run.. The long-term trend is classified as Bullish.

What are the key support levels for AMZN?

StockDips.AI has identified key support levels for AMZN at $229.25 and $214.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is AMZN in a significant dip or a Value Dip right now?

AMZN has a Value Score of 129/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.