META Daily Technical Analysis

Meta Platforms Inc

Owner of Facebook, Instagram, and WhatsApp with investment in AI and virtual reality.

META Technical Analysis Summary

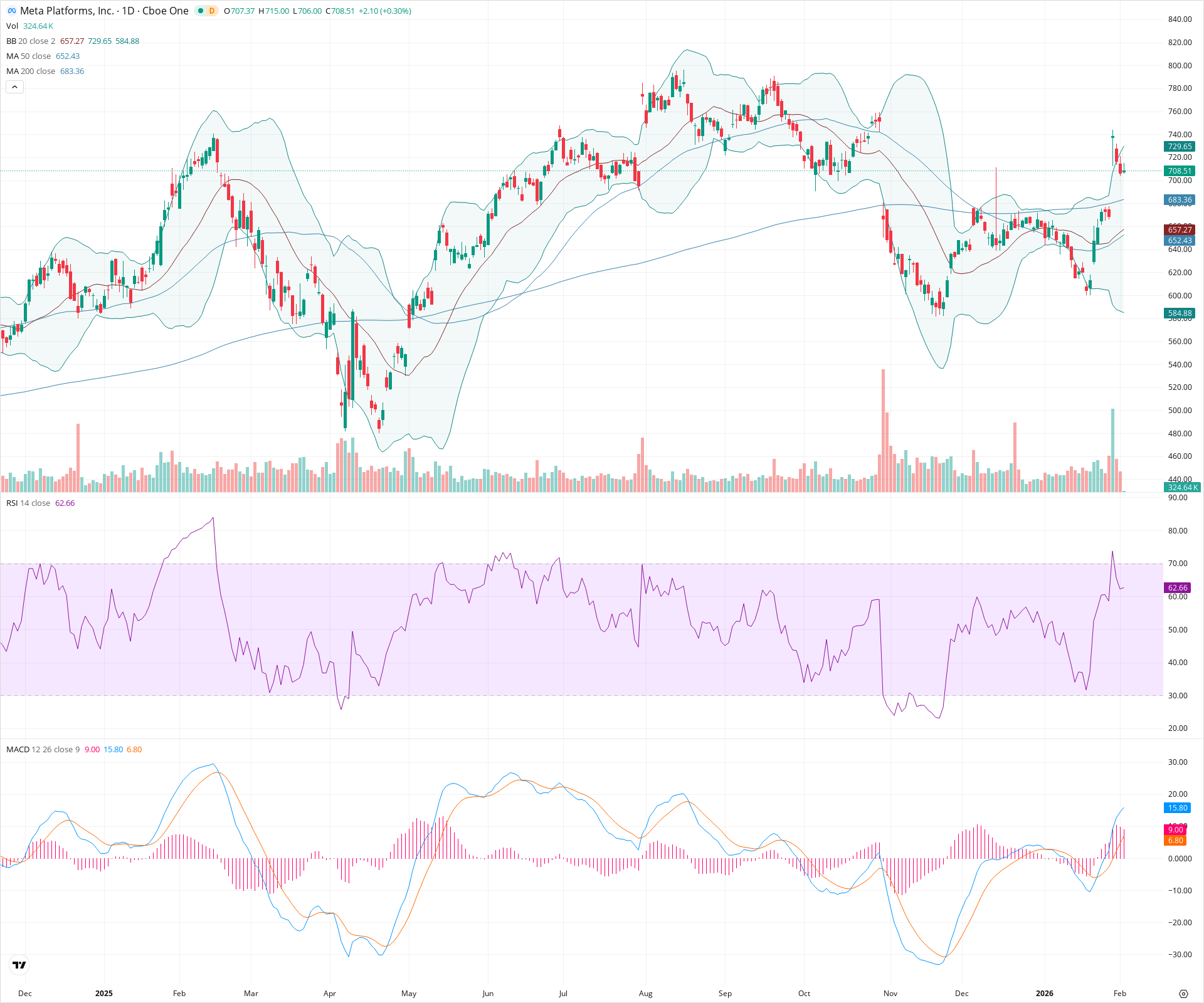

META is exhibiting a strong V-shaped recovery, recently reclaiming the critical 200-day SMA at 683.36, which now serves as key support. Technical indicators are aligned bullishly, with the MACD showing positive momentum and the RSI rising within bullish territory. The primary objective for bulls is to sustain price action above the 200-day SMA and challenge the recent swing highs near 740, with the major structural resistance at 780 being the longer-term target.

Included In Lists

Related Tickers of Interest

META Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is trading strongly above the 20, 50, and 200-day SMAs with rising momentum. The RSI is bullish (62.66) but not yet overbought, leaving room for further upside.

Long-term Sentiment (weeks to months): Bullish

The stock has successfully reclaimed the 200-day SMA (683.36) after a significant correction. The 50-day SMA is beginning to curl upward, suggesting a potential medium-to-long term trend reversal back to the upside.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:03:49.018Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $682.50 | $680.00 - $685.00 | Strong | Confluence of the 200-day SMA and recent consolidation zone. |

| $654.00 | $650.00 - $658.00 | Strong | Cluster containing the 50-day SMA and the 20-day SMA (Bollinger midline). |

| $580.00 | $575.00 - $585.00 | Strong | Major swing low / base of the current recovery rally. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $737.50 | $730.00 - $745.00 | Weak | Recent local swing high achieved during the current rally. |

| $780.00 | $775.00 - $785.00 | Strong | Major previous peak / structural resistance established in the prior uptrend. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | 200-day SMA Breakout | Bullish | $780.00 | Price has decisively broken and held above the 200-day Simple Moving Average, a key indicator of long-term trend health. |

| Strong | V-Shaped Recovery | Bullish | N/A | Sharp reversal from the November lows around 560, erasing losses rapidly without a prolonged base. |

| Weak | Bullish MACD Crossover | Bullish | N/A | MACD line has crossed above the Signal line with a positive histogram, confirming upward momentum. |

Frequently Asked Questions about META

What is the current sentiment for META?

The short-term sentiment for META is currently Bullish because Price is trading strongly above the 20, 50, and 200-day SMAs with rising momentum. The RSI is bullish (62.66) but not yet overbought, leaving room for further upside.. The long-term trend is classified as Bullish.

What are the key support levels for META?

StockDips.AI has identified key support levels for META at $682.50 and $654.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is META in a significant dip or a Value Dip right now?

META has a Value Score of 70/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.