ASTS Daily Technical Analysis

AST SpaceMobile, Inc

Aerospace and satellite communications company that is building the first and only space-based cellular broadband network designed to connect directly with standard, unmodified mobile phones. The company's mission is to eliminate connectivity gaps globally by providing 4G and 5G coverage in remote and underserved regions where traditional ground infrastructure is unavailable.

ASTS Technical Analysis Summary

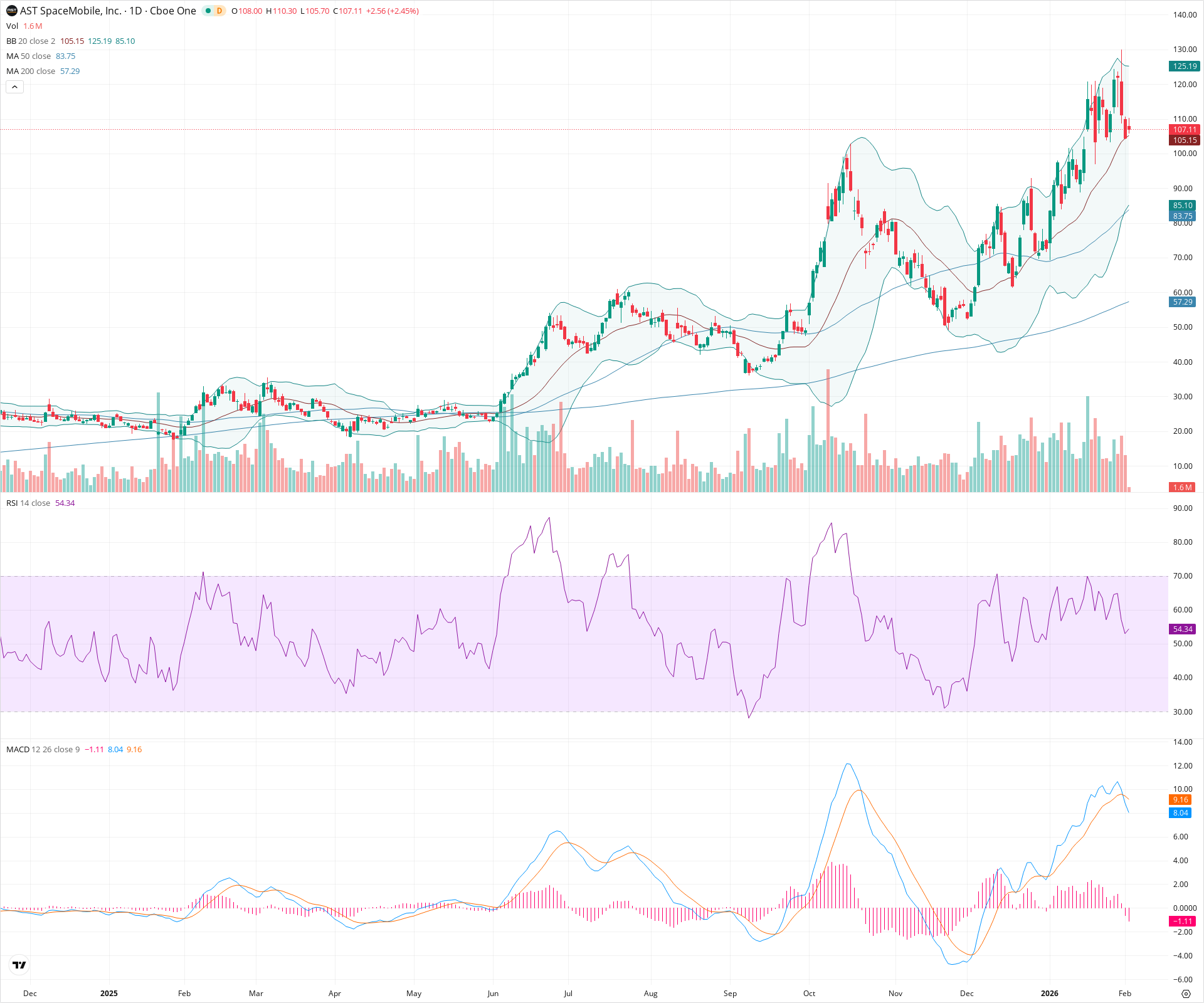

ASTS is in a robust long-term uptrend but is currently experiencing a healthy short-term correction after a parabolic move to ~$130. The price is testing immediate support at the 20-day SMA (~105), and a failure to hold here could see a deeper retracement toward the 50-day SMA around $84. While momentum indicators like MACD favor bears temporarily, the broader structure remains bullish.

Included In Lists

Related Tickers of Interest

ASTS Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

The stock is undergoing a sharp correction from recent highs (~130), marked by consecutive red candles and a bearish MACD crossover. Momentum is negative as price tests the 20-day SMA.

Long-term Sentiment (weeks to months): Bullish

The long-term trend remains firmly upward, with price trading well above the rising 50-day (83.75) and 200-day (57.29) moving averages.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:16:16.418Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $105.00 | $104.00 - $106.00 | Weak | Immediate dynamic support provided by the 20-day SMA (middle Bollinger Band). |

| $85.50 | $83.00 - $88.00 | Strong | Confluence of the rising 50-day SMA and previous consolidation highs. |

| $70.00 | $68.00 - $72.00 | Strong | Major prior breakout zone and structural support. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $116.50 | $115.00 - $118.00 | Weak | Mid-range resistance formed during the descent from the highs. |

| $127.50 | $125.00 - $130.00 | Strong | Recent all-time highs where strong selling pressure emerged (upper Bollinger Band area). |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Pullback / Mean Reversion | Neutral | $105.00 | After a parabolic run-up, price is reverting to the mean (20-day SMA) to digest gains. |

| Strong | MACD Bearish Crossover | Bearish | N/A | The MACD line has crossed below the Signal line at a high level, confirming the recent loss of momentum. |

Frequently Asked Questions about ASTS

What is the current sentiment for ASTS?

The short-term sentiment for ASTS is currently Bearish because The stock is undergoing a sharp correction from recent highs (~130), marked by consecutive red candles and a bearish MACD crossover. Momentum is negative as price tests the 20-day SMA.. The long-term trend is classified as Bullish.

What are the key support levels for ASTS?

StockDips.AI has identified key support levels for ASTS at $105.00 and $85.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is ASTS in a significant dip or a Value Dip right now?

ASTS has a Value Score of 64/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.