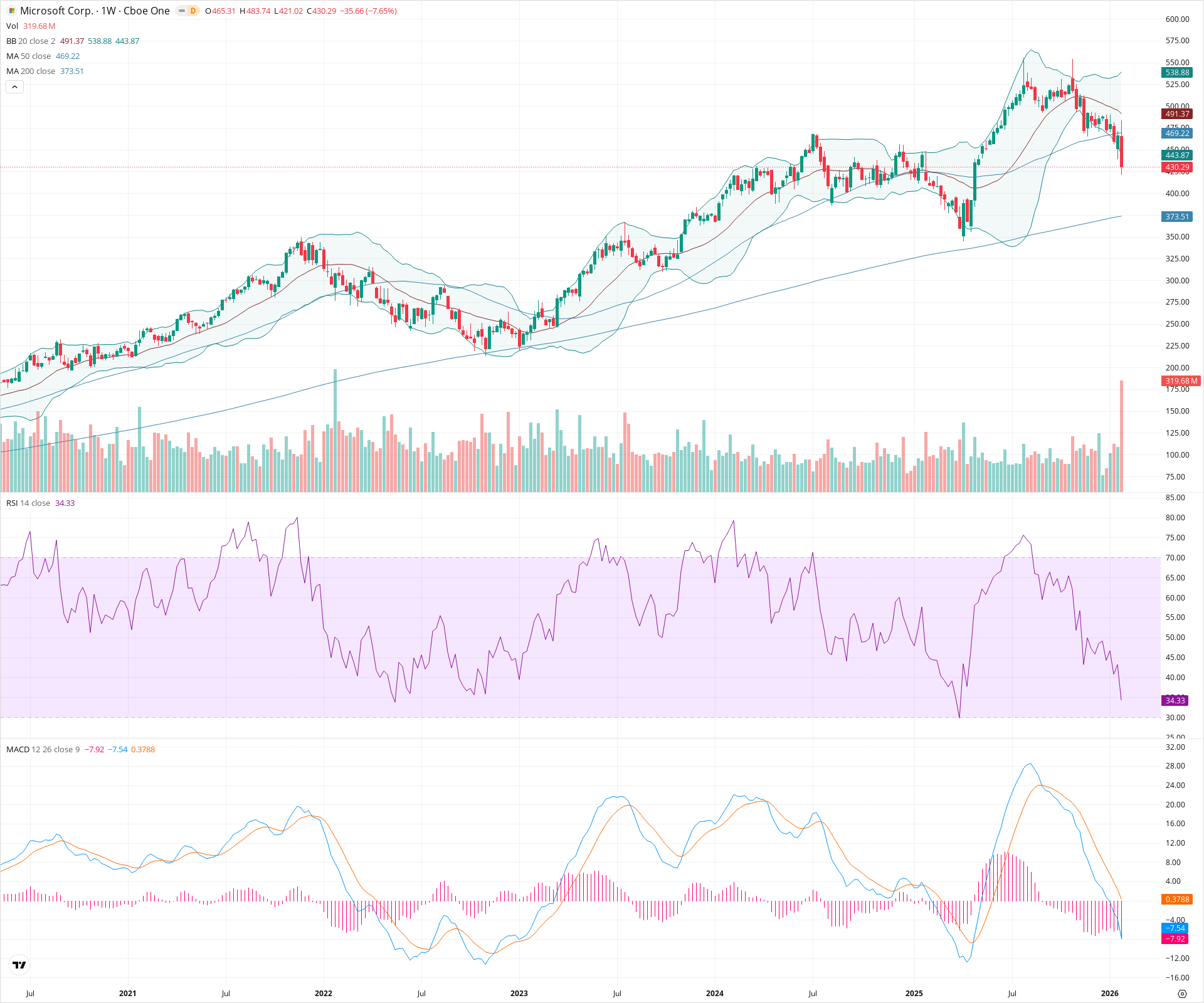

MSFT Weekly Technical Analysis

Microsoft Corporation

Develops software, cloud computing, and AI tools including Windows, Office, and Azure.

MSFT Technical Analysis Summary

Microsoft is experiencing a significant short-term correction, marked by a high-volume breakdown below its 50-week SMA and lower Bollinger Band. While the immediate momentum is strongly bearish, dragging RSI lower, the long-term bullish trend remains valid as long as price holds above the 200-week SMA near 373. Investors should monitor the 400-415 zone for signs of stabilization.

Included In Lists

Related Tickers of Interest

MSFT Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

Price has posted a massive bearish weekly candle (-7.65%), breaking below the 50-week SMA and the Lower Bollinger Band on high volume. RSI is plunging towards oversold territory.

Long-term Sentiment (weeks to months): Bullish

Despite the sharp correction, the primary uptrend structure remains intact with the price well above the rising 200-week SMA (373.51) and the 50-week SMA still positioned above the 200-week SMA.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-01-31T23:28:54.312Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $405.00 | $395.00 - $415.00 | Strong | Consolidation zone from early 2024 and psychological support. |

| $372.50 | $370.00 - $375.00 | Strong | Confluence with the 200-week SMA (373.51). |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $446.50 | $443.00 - $450.00 | Weak | Previous support turned resistance; coincides with the Lower Bollinger Band (443.87). |

| $472.00 | $469.00 - $475.00 | Strong | 50-week SMA (469.22) and recent consolidation highs. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bearish Breakdown | Bearish | $400.00 | A decisive long red candle breaking below the 50-week SMA and the consolidation range held since mid-2024. |

| Strong | MACD Crossover | Bearish | N/A | The MACD line has crossed below the signal line with an expanding negative histogram, confirming downward momentum. |

Frequently Asked Questions about MSFT

What is the current sentiment for MSFT?

The short-term sentiment for MSFT is currently Bearish because Price has posted a massive bearish weekly candle (-7.65%), breaking below the 50-week SMA and the Lower Bollinger Band on high volume. RSI is plunging towards oversold territory.. The long-term trend is classified as Bullish.

What are the key support levels for MSFT?

StockDips.AI has identified key support levels for MSFT at $405.00 and $372.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is MSFT in a significant dip or a Value Dip right now?

MSFT has a Value Score of 62/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.