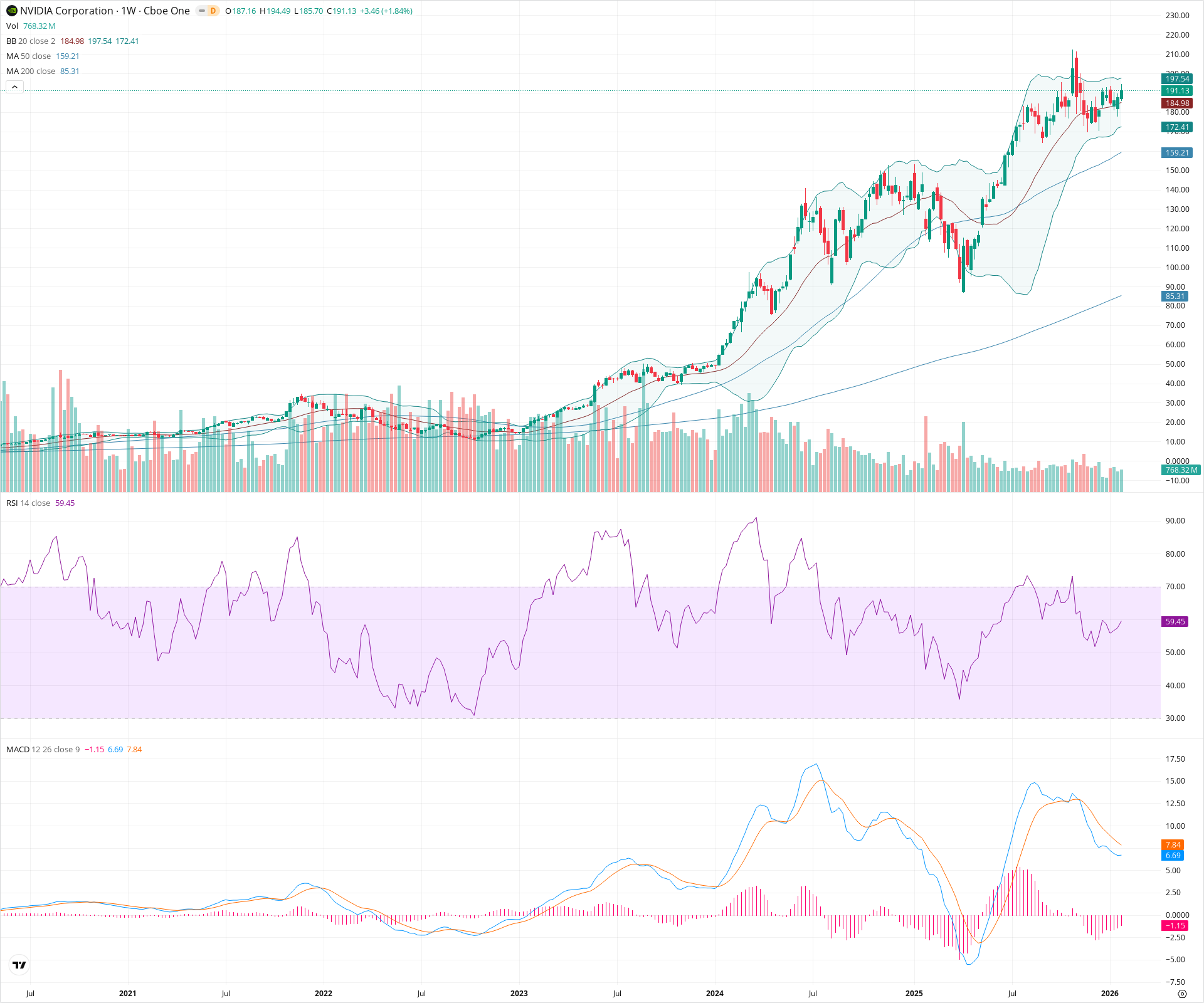

NVDA Weekly Technical Analysis

NVIDIA Corporation

Designs GPUs and AI chips for gaming, data centers, and artificial intelligence systems.

NVDA Technical Analysis Summary

NVDA remains in a robust long-term uptrend, indicated by the steep upward slope of the 50-week and 200-week moving averages. Over the past few months, the stock has formed a consolidation pattern just below the 200 level, digesting previous gains while holding above the 20-week SMA. Short-term momentum is recovering as the MACD histogram negativity shortens and price pushes toward the upper resistance band.

Included In Lists

Related Tickers of Interest

NVDA Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is trading above the rising 20-week SMA and rebounding from the lower bound of a consolidation range. RSI is in bullish territory above 50.

Long-term Sentiment (weeks to months): Bullish

The stock is in a confirmed strong uptrend, trading well above the rising 50-week and 200-week SMAs with no signs of structural breakdown.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-01-31T23:27:36.910Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $184.50 | $184.00 - $185.00 | Weak | Dynamic support provided by the 20-week SMA/Bollinger Band basis line. |

| $172.50 | $170.00 - $175.00 | Strong | Lower boundary of the current multi-month consolidation range and recent swing lows. |

| $157.50 | $155.00 - $160.00 | Strong | Confluence of previous consolidation highs and the rising 50-week SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $198.50 | $197.00 - $200.00 | Strong | Recent all-time highs and the upper Bollinger Band; psychological round number resistance. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bullish Consolidation / High Base | Bullish | N/A | After a significant vertical rally, the price has been moving sideways in a defined range (approx. 170-197), allowing moving averages to catch up. |

Frequently Asked Questions about NVDA

What is the current sentiment for NVDA?

The short-term sentiment for NVDA is currently Bullish because Price is trading above the rising 20-week SMA and rebounding from the lower bound of a consolidation range. RSI is in bullish territory above 50.. The long-term trend is classified as Bullish.

What are the key support levels for NVDA?

StockDips.AI has identified key support levels for NVDA at $184.50 and $172.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is NVDA in a significant dip or a Value Dip right now?

NVDA has a Value Score of 129/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.