MU Daily Technical Analysis

Micron Technology Inc

American producer of computer memory and data storage solutions, including DRAM (dynamic random-access memory) and NAND flash memory products. Their products are essential for a wide range of applications, from personal computers and mobile devices to data centers and automotive systems.

MU Technical Analysis Summary

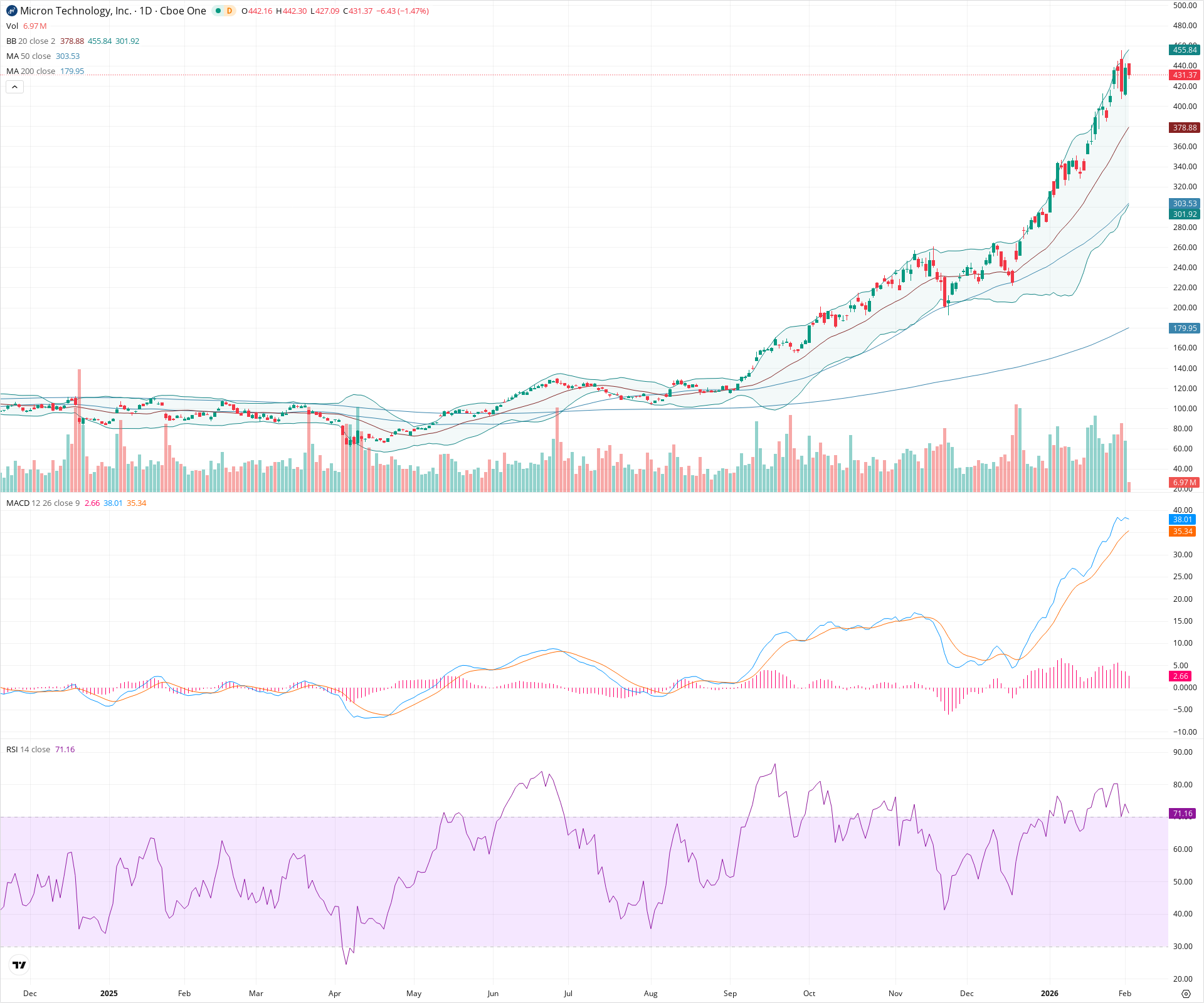

Micron Technology is in a robust long-term uptrend, characterized by a parabolic move that has taken the price well above its long-term moving averages. However, short-term indicators such as an overbought RSI and contracting MACD histogram point to exhaustion and a likely consolidation or pullback toward the 20-day SMA. Investors should remain bullish on the trend but exercise caution regarding immediate entries due to the extended deviation from mean support levels.

Included In Lists

Related Tickers of Interest

MU Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

While the primary trend is up, the stock is experiencing a pullback from recent highs with RSI in overbought territory (>70) and waning MACD momentum.

Long-term Sentiment (weeks to months): Bullish

Price is trading significantly above the rising 50-day and 200-day SMAs, showing a strong, established parabolic uptrend.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:06:32.517Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $377.50 | $375.00 - $380.00 | Strong | Confluence of the 20-day SMA and the middle Bollinger Band. |

| $342.50 | $335.00 - $350.00 | Weak | Previous consolidation zone and swing highs prior to the most recent vertical leg. |

| $302.50 | $300.00 - $305.00 | Strong | Aligns with the 50-day SMA and lower Bollinger Band. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $457.50 | $455.00 - $460.00 | Weak | Upper Bollinger Band area acting as dynamic resistance. |

| $472.50 | $470.00 - $475.00 | Strong | Recent all-time high swing peak. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Parabolic Uptrend | Bullish | N/A | Price has advanced vertically away from moving averages, indicating extreme bullishness but also high risk of a mean-reversion pullback. |

| Weak | RSI Bearish Divergence | Bearish | $380.00 | While price has made new highs, the RSI is making lower highs (peaking lower than the previous surge), suggesting upward momentum is exhausting. |

Frequently Asked Questions about MU

What is the current sentiment for MU?

The short-term sentiment for MU is currently Neutral because While the primary trend is up, the stock is experiencing a pullback from recent highs with RSI in overbought territory (>70) and waning MACD momentum.. The long-term trend is classified as Bullish.

What are the key support levels for MU?

StockDips.AI has identified key support levels for MU at $377.50 and $342.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is MU in a significant dip or a Value Dip right now?

MU has a Value Score of 56/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.