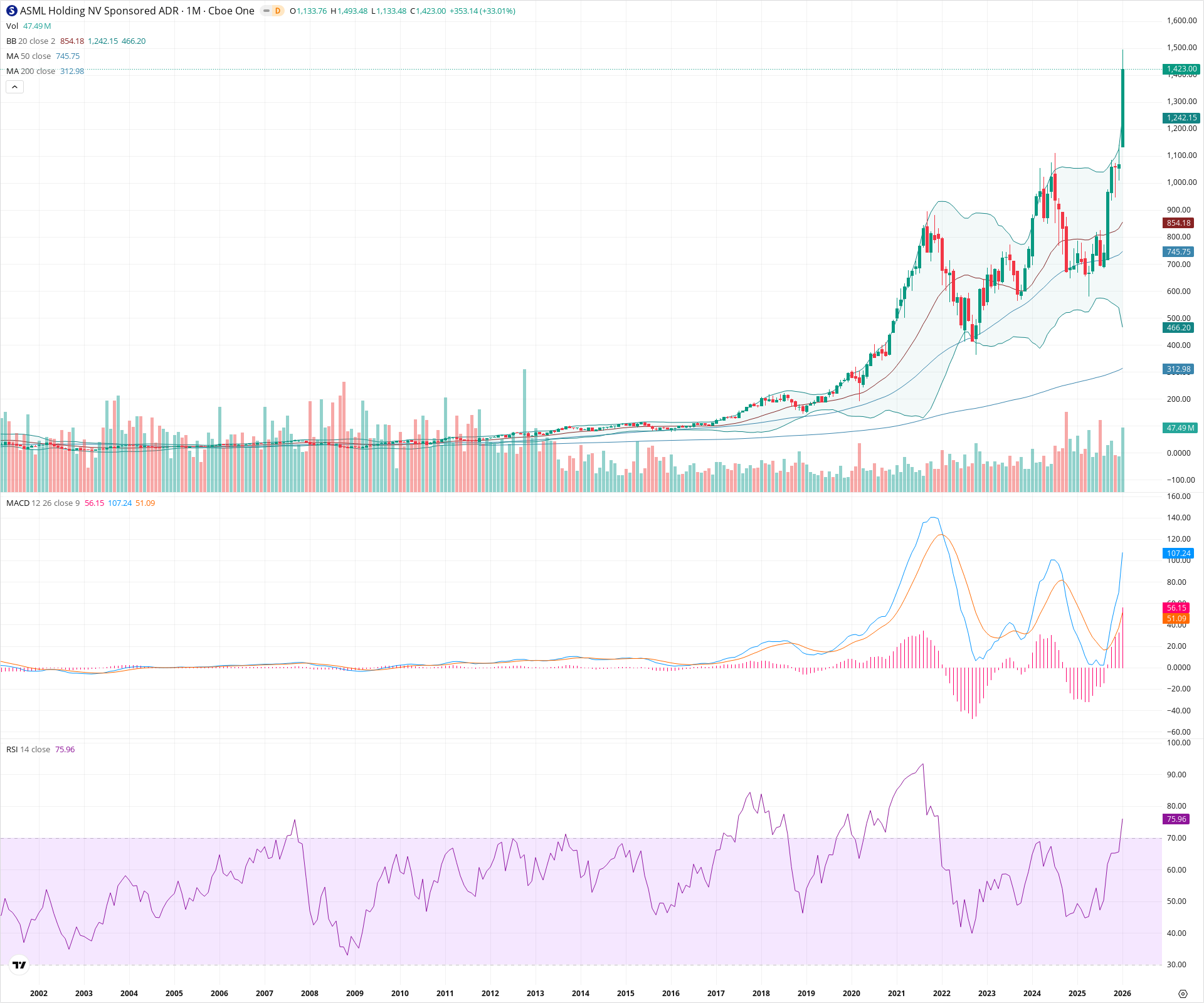

ASML Monthly Technical Analysis

ASML Holding

Manufactures advanced lithography machines essential for semiconductor manufacturing.

ASML Technical Analysis Summary

ASML has decisively broken out of a multi-year consolidation pattern to reach new all-time highs, driven by powerful momentum as indicated by the expanding MACD and high RSI. The price is currently riding well above the upper Bollinger Band, reflecting a high-volatility bullish expansion phase. While the vertical move suggests strong conviction, the extension suggests potential for future volatility, though the long-term structural trend remains firmly positive.

Included In Lists

Related Tickers of Interest

ASML Monthly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price has printed a massive bullish candle (+33%) breaking out to all-time highs. RSI is above 70 (75.96) and price is extending well beyond the upper Bollinger Band, indicating extreme momentum.

Long-term Sentiment (weeks to months): Bullish

The chart shows a confirmed resumption of a secular uptrend. The 20, 50, and 200 SMAs are in perfect bullish alignment and rising. MACD has crossed bullishly and is expanding above the zero line.

Report Metadata

- Timeframe: monthly

- Generated at: 2026-02-02T05:11:35.910Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $1,075.00 | $1,050.00 - $1,100.00 | Strong | Recent breakout zone from the 2023-2024 consolidation phase. |

| $890.00 | $880.00 - $900.00 | Strong | Former major all-time high from 2021 acting as significant structural support. |

| $745.00 | $740.00 - $750.00 | Strong | Confluence of the 50-month SMA and historical support levels. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $1,493.48 | $1,493.48 - $1,493.48 | Weak | Current monthly high and all-time high; represents the only overhead price resistance. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Cup and Handle Breakout | Bullish | N/A | A multi-year saucer/cup formation starting from the 2021 peak, with a consolidation 'handle' in 2023-2024, followed by a decisive breakout to new highs. |

Frequently Asked Questions about ASML

What is the current sentiment for ASML?

The short-term sentiment for ASML is currently Bullish because Price has printed a massive bullish candle (+33%) breaking out to all-time highs. RSI is above 70 (75.96) and price is extending well beyond the upper Bollinger Band, indicating extreme momentum.. The long-term trend is classified as Bullish.

What are the key support levels for ASML?

StockDips.AI has identified key support levels for ASML at $1,075.00 and $890.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is ASML in a significant dip or a Value Dip right now?

ASML has a Value Score of 70/100. It is currently flagged as a significant dip in the Top Dips list. It is also listed as a Value Dip because long-term sentiment is bullish.

View the full interactive analysis on StockDips.AI.