GLD Daily Technical Analysis

SPDR Gold Shares

Tracks the spot price of physical gold bullion held in secure vaults. Roughly ~1/10 oz of gold per share. Often used as a hedge against inflation, currency debasement, geopolitical risk, and financial market stress. Gold is considered a store of value and tends to perform well during risk-off environments.

GLD Technical Analysis Summary

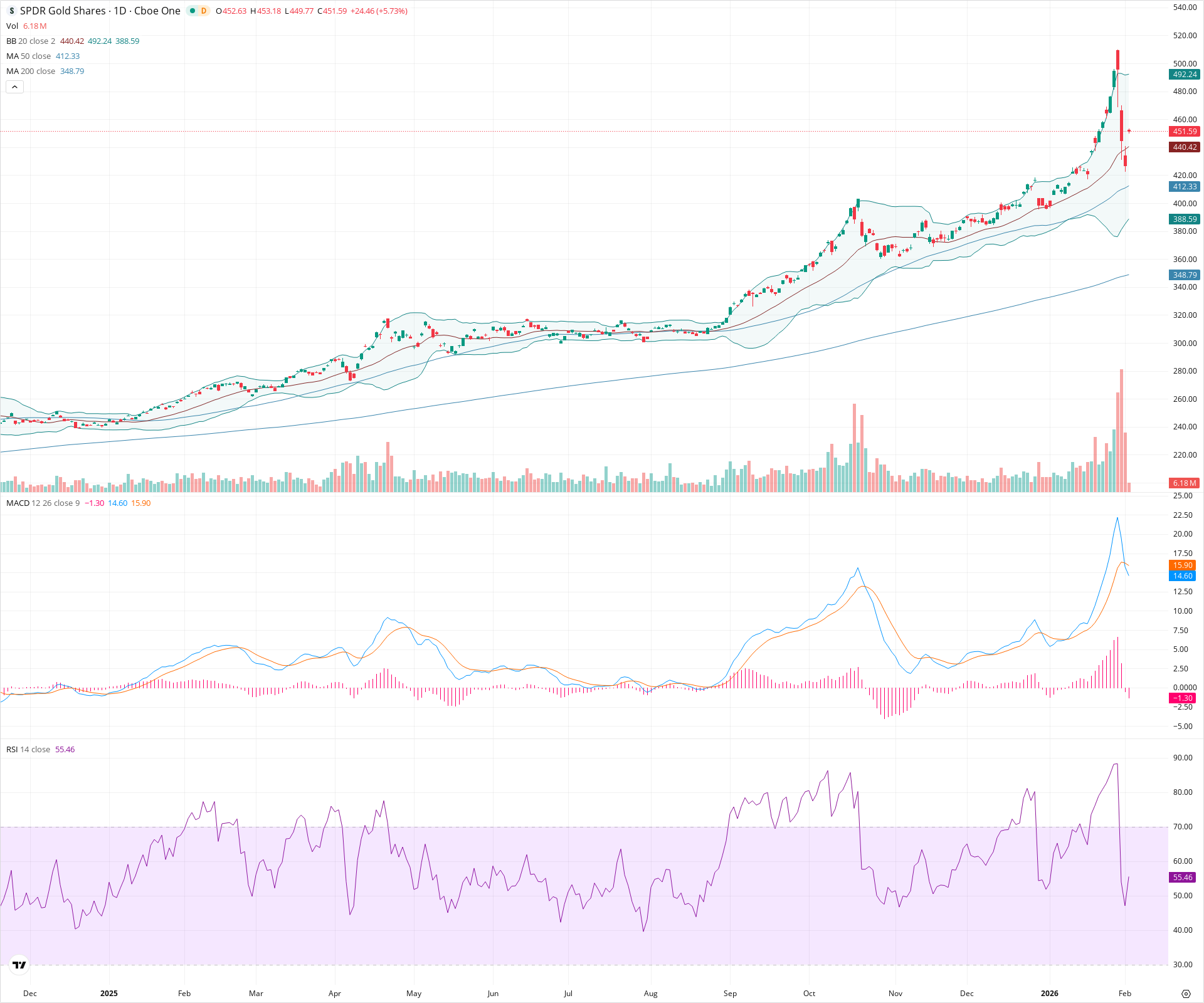

GLD remains in a dominant long-term uptrend but is currently undergoing a volatility contraction and mean reversion phase after a parabolic run to 500. Short-term momentum indicators like MACD (bearish cross) and RSI (dropping from overbought) suggest cooling buying pressure. Investors should watch the 20-day and 50-day SMAs as key support zones for the broader trend to resume.

Included In Lists

Related Tickers of Interest

GLD Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

Price is experiencing high volatility following a sharp correction from recent highs. While today shows a strong bounce (+5.73%), the candle is red (closed lower than open), and the MACD has recently crossed bearishly with a negative histogram, suggesting momentum is cooling.

Long-term Sentiment (weeks to months): Bullish

The long-term trend remains strongly upward, with price significantly above both the rising 50-day (412.33) and 200-day (348.79) SMAs. The 50-day SMA is well above the 200-day SMA, confirming a healthy bullish trend structure.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:20:08.116Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $440.46 | $440.42 - $440.50 | Weak | 20-day SMA / Bollinger Band basis line, acting as immediate dynamic support. |

| $428.50 | $427.00 - $430.00 | Strong | Recent swing low and approximate gap fill area from the latest rebound. |

| $412.16 | $412.00 - $412.33 | Strong | 50-day Moving Average. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $452.91 | $452.63 - $453.18 | Weak | Current daily open and high. |

| $496.12 | $492.24 - $500.00 | Strong | Upper Bollinger Band and recent parabolic peak/psychological round number. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Parabolic Blow-off Top | Bearish | $412.33 | Price ascended vertically into the 500 level before sharply correcting, indicating buyer exhaustion and a climax pattern. |

| Strong | Mean Reversion | Neutral | $440.42 | After extending far beyond the moving averages (overbought RSI near 90), price is reverting towards the mean (20 and 50 SMAs). |

Frequently Asked Questions about GLD

What is the current sentiment for GLD?

The short-term sentiment for GLD is currently Neutral because Price is experiencing high volatility following a sharp correction from recent highs. While today shows a strong bounce (+5.73%), the candle is red (closed lower than open), and the MACD has recently crossed bearishly with a negative histogram, suggesting momentum is cooling.. The long-term trend is classified as Bullish.

What are the key support levels for GLD?

StockDips.AI has identified key support levels for GLD at $440.46 and $428.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is GLD in a significant dip or a Value Dip right now?

GLD has a Value Score of 19/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.