SLV Daily Technical Analysis

iShares Silver Trust

Tracks the price of physical silver bullion. Silver has both monetary and industrial uses, making it more volatile than gold. It is commonly viewed as a leveraged play on precious metals with sensitivity to economic growth, inflation, and speculative cycles.

SLV Technical Analysis Summary

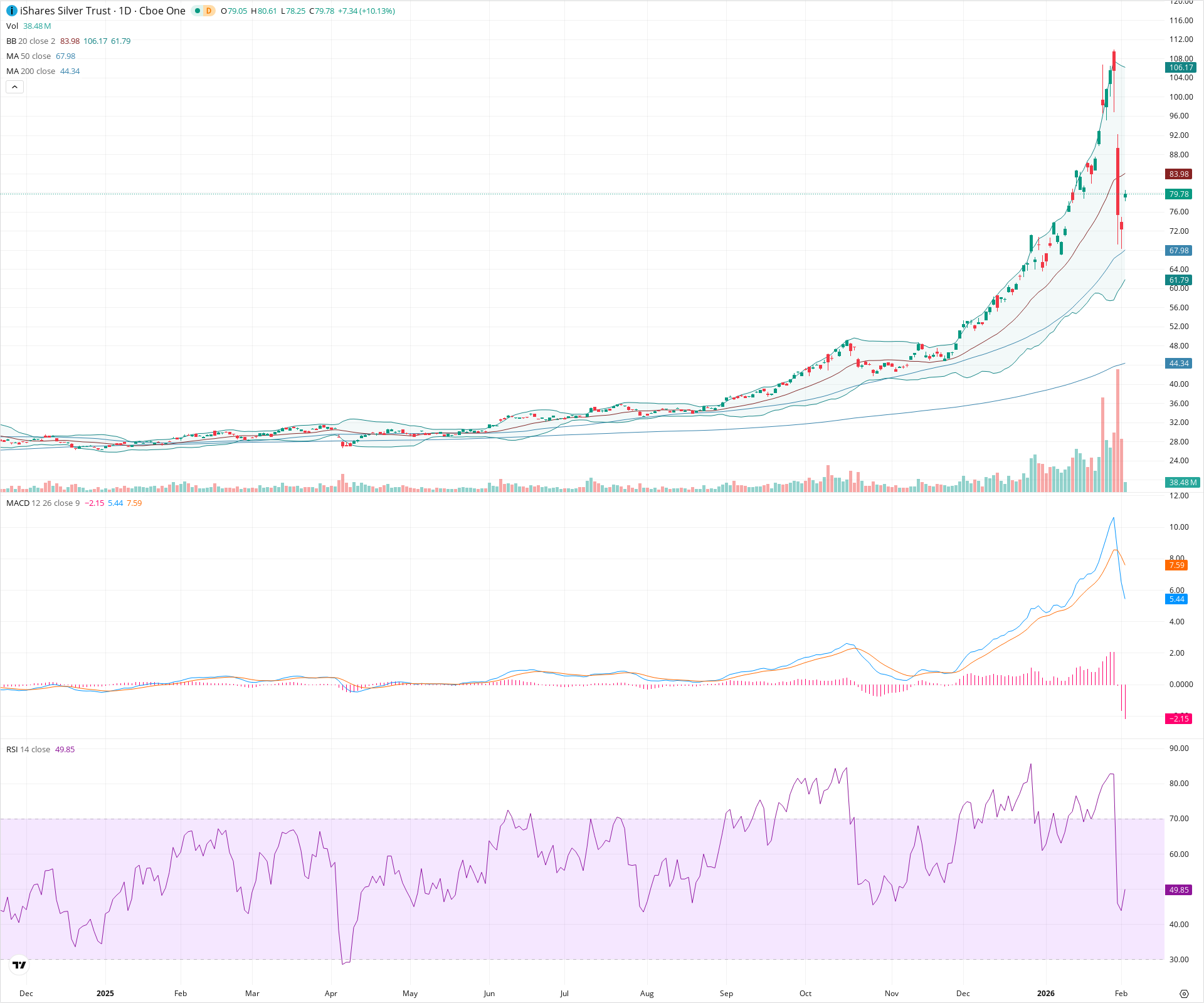

SLV is undergoing a significant correction following a parabolic advance that peaked near 114.00. While the long-term trend remains intact above the 50-day and 200-day SMAs, short-term indicators are bearish, highlighted by a MACD sell signal and price falling below the 20-day SMA. The current session shows a strong 10% rebound as RSI resets to neutral (approx. 50), but the asset faces immediate resistance at the 20-day SMA around 84.00.

Included In Lists

Related Tickers of Interest

SLV Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

Price is trading below the 20-day SMA, and the MACD has recently confirmed a bearish crossover with expanding negative histogram, despite a strong single-day bounce.

Long-term Sentiment (weeks to months): Bullish

The price remains well above the rising 50-day and 200-day SMAs, maintaining the primary uptrend structure despite the recent sharp correction.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:15:28.516Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $68.25 | $67.50 - $69.00 | Strong | Confluence of the 50-day SMA (67.98) and previous consolidation zones. |

| $61.00 | $60.00 - $62.00 | Weak | Aligns with the lower Bollinger Band and older price structure. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $84.00 | $83.50 - $84.50 | Strong | The 20-day SMA acts as immediate dynamic resistance. |

| $98.00 | $96.00 - $100.00 | Weak | Psychological level and midpoint of the recent breakdown. |

| $113.00 | $112.00 - $114.00 | Strong | Recent swing high and peak of the parabolic move. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bearish MACD Crossover | Bearish | N/A | The MACD line has crossed below the signal line with a falling histogram, indicating a shift in momentum to the downside. |

| Strong | Parabolic Blow-off Top | Bearish | $68.00 | The price exhibited a vertical ascent followed by a sharp collapse, typical of a climax top pattern. |

Frequently Asked Questions about SLV

What is the current sentiment for SLV?

The short-term sentiment for SLV is currently Bearish because Price is trading below the 20-day SMA, and the MACD has recently confirmed a bearish crossover with expanding negative histogram, despite a strong single-day bounce.. The long-term trend is classified as Bullish.

What are the key support levels for SLV?

StockDips.AI has identified key support levels for SLV at $68.25 and $61.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is SLV in a significant dip or a Value Dip right now?

SLV has a Value Score of 52/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.