URA Daily Technical Analysis

Global X Uranium ETF

Provides exposure to companies involved in uranium mining, nuclear fuel production, and nuclear energy infrastructure. Uranium demand is driven by global nuclear power adoption, energy security concerns, and decarbonization initiatives.

URA Technical Analysis Summary

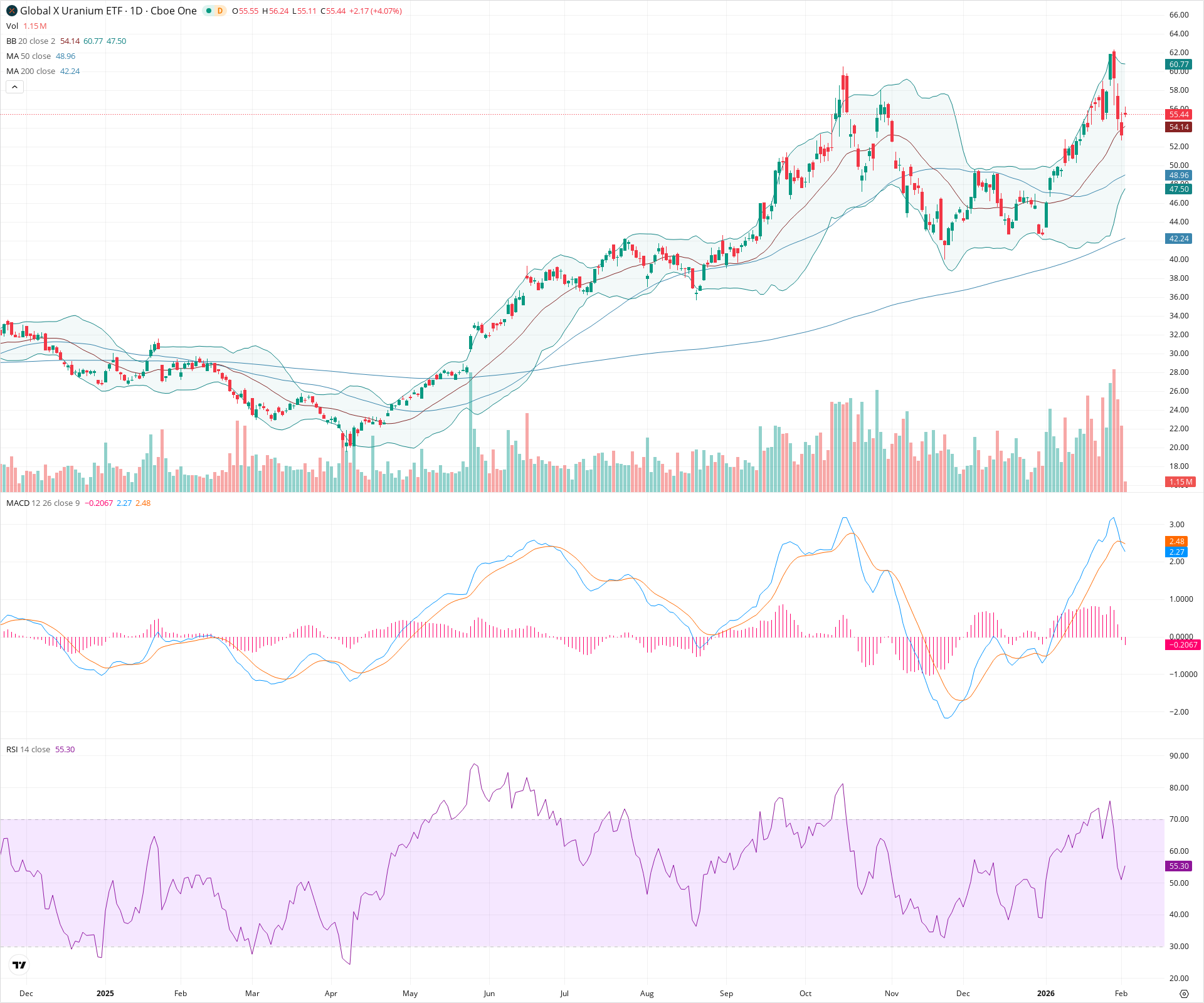

URA maintains a strong long-term bullish structure, trading significantly above its rising 50-day and 200-day moving averages. Recently, momentum has cooled as evidenced by the bearish MACD crossover and RSI pullback from overbought territory. The current price action suggests a consolidation phase or potential bull flag formation following the sharp run-up to 62.00. Investors should watch the 50-day SMA as a critical dynamic support level if the correction deepens.

Included In Lists

Related Tickers of Interest

URA Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

Price is correcting from recent highs with a confirmed bearish MACD crossover and negative histogram. However, the price gapped up significantly (+4.07%) today, indicating buying interest despite the red candle body.

Long-term Sentiment (weeks to months): Bullish

The stock is in a confirmed uptrend, trading well above both the rising 50-day and 200-day Simple Moving Averages. The 'Golden Cross' alignment (50 SMA > 200 SMA) remains intact.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:17:45.817Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $53.50 | $53.00 - $54.00 | Weak | Immediate swing low from the recent pullback. |

| $49.25 | $48.50 - $50.00 | Strong | Confluence of the rising 50-day SMA and previous resistance-turned-support from December. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $57.50 | $57.00 - $58.00 | Weak | Intraday resistance zone during the recent gap down. |

| $61.64 | $60.77 - $62.50 | Strong | Upper Bollinger Band and recent swing high peak. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Weak | Bullish Trend Pullback | Bullish | N/A | After a strong parabolic move to ~62.00, price has retraced towards the 20-day moving average area to cool off indicators. |

Frequently Asked Questions about URA

What is the current sentiment for URA?

The short-term sentiment for URA is currently Neutral because Price is correcting from recent highs with a confirmed bearish MACD crossover and negative histogram. However, the price gapped up significantly (+4.07%) today, indicating buying interest despite the red candle body.. The long-term trend is classified as Bullish.

What are the key support levels for URA?

StockDips.AI has identified key support levels for URA at $53.50 and $49.25. These levels may represent potential accumulation zones where buying interest could emerge.

Is URA in a significant dip or a Value Dip right now?

URA has a Value Score of 67/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.