GRAB Daily Technical Analysis

Grab Holdings Ltd

Southeast Asian super app offering ride-hailing, food delivery, and financial services.

GRAB Technical Analysis Summary

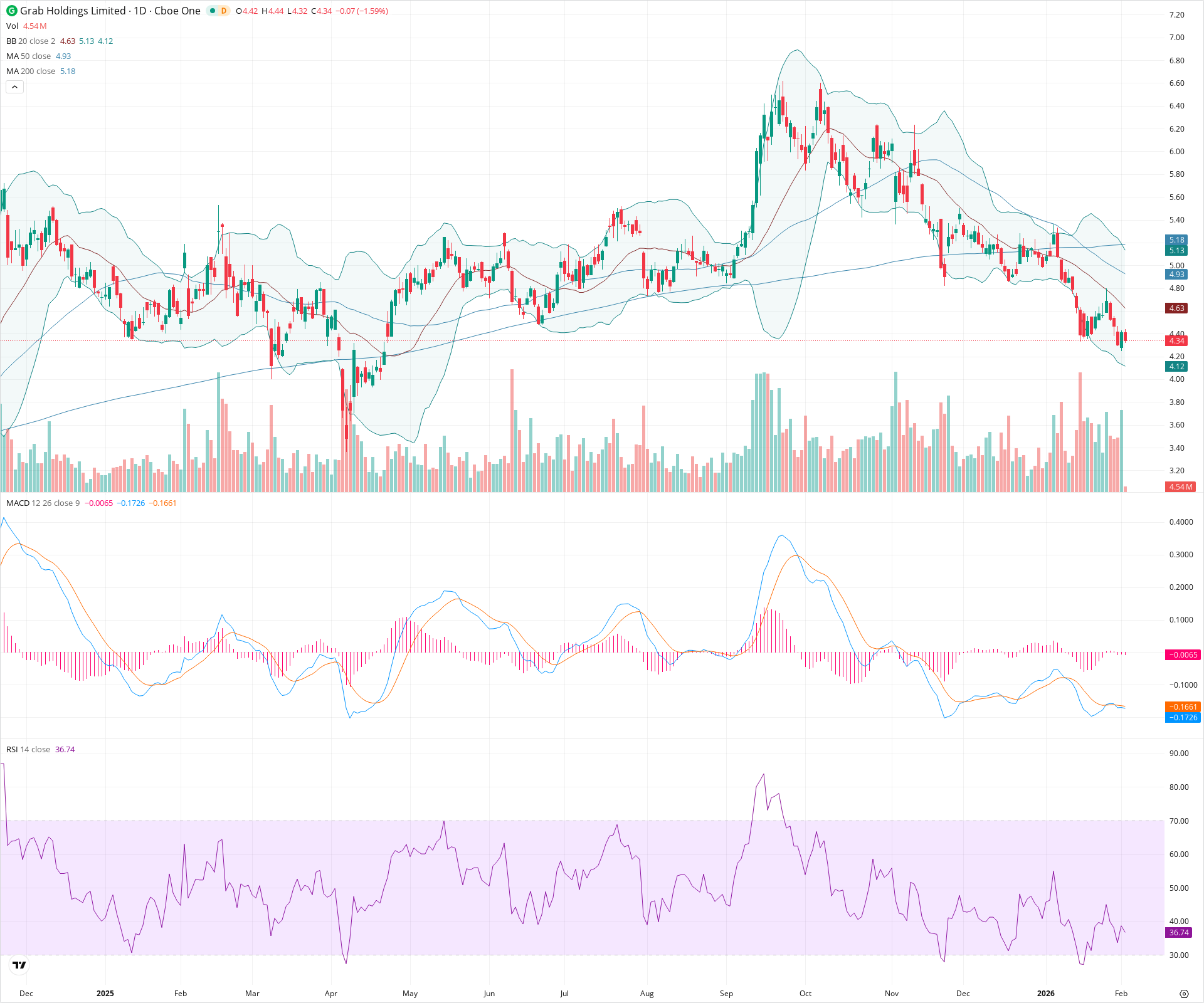

Grab Holdings is exhibiting a strong bearish trend across both short and long timeframes, currently trading below all key moving averages (20, 50, and 200-day SMAs). The recent 'Death Cross' reinforces the negative long-term outlook, while the RSI near 37 suggests there is still room for further downside before becoming technically oversold. Immediate support lies near 4.12; a failure to hold this level could see the price drift toward historical support zones around 3.50.

Included In Lists

Related Tickers of Interest

GRAB Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

Price is trading below the 20-day SMA (4.63) with recent candles showing continued selling pressure. RSI is weak at 36.74, and MACD remains below the signal line.

Long-term Sentiment (weeks to months): Bearish

The stock is trading well below the 200-day SMA (5.18). A 'Death Cross' is visible where the 50-day SMA has crossed below the 200-day SMA, confirming a major downtrend.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:14:45.817Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $4.16 | $4.12 - $4.20 | Weak | Aligns with the recent swing low and the current lower Bollinger Band. |

| $3.35 | $3.20 - $3.50 | Strong | Major structural support zone established during the consolidation period on the left side of the chart. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $4.67 | $4.63 - $4.70 | Weak | Coincides with the 20-day SMA basis line and recent breakdown area. |

| $5.06 | $4.93 - $5.18 | Strong | Significant confluence zone containing the 50-day SMA and 200-day SMA. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Death Cross | Bearish | N/A | The 50-day SMA (4.93) has crossed below the 200-day SMA (5.18), a classic long-term bearish signal indicating trend deterioration. |

| Strong | Downtrend Channel | Bearish | $4.12 | Since the peak in October, price action has formed a series of lower highs and lower lows. |

Frequently Asked Questions about GRAB

What is the current sentiment for GRAB?

The short-term sentiment for GRAB is currently Bearish because Price is trading below the 20-day SMA (4.63) with recent candles showing continued selling pressure. RSI is weak at 36.74, and MACD remains below the signal line.. The long-term trend is classified as Bearish.

What are the key support levels for GRAB?

StockDips.AI has identified key support levels for GRAB at $4.16 and $3.35. These levels may represent potential accumulation zones where buying interest could emerge.

Is GRAB in a significant dip or a Value Dip right now?

GRAB has a Value Score of 89/100. It is currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.