MELI Daily Technical Analysis

MercadoLibre Inc

Latin America's leading e-commerce and digital payments company.

MELI Technical Analysis Summary

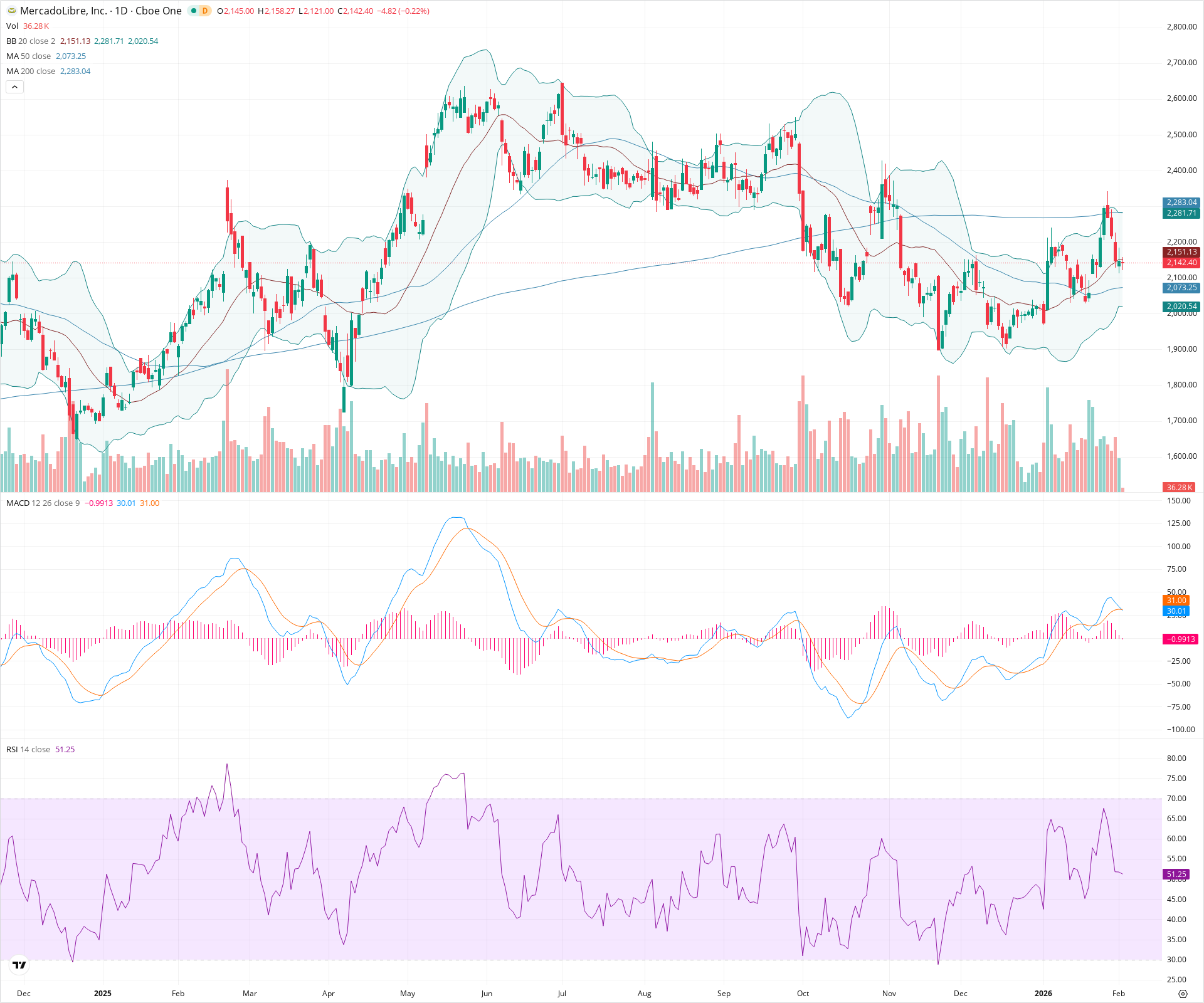

MELI is currently in a period of indecision, trading in a tightening range between the 50-day SMA support and overhead resistance near the 200-day SMA. Momentum indicators like the MACD and RSI are flat, confirming the lack of a dominant trend. A clear breakout above the 2280–2300 zone is required to regain a bullish long-term posture, while a breakdown below 2070 could signal further weakness.

Included In Lists

Related Tickers of Interest

MELI Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

Price is consolidating sideways with RSI at 51 (midpoint) and MACD virtually flat, showing no clear directional momentum. The price is currently stuck between the 20-day SMA resistance and 50-day SMA support.

Long-term Sentiment (weeks to months): Neutral

The stock is in a broad consolidation phase, trading below the long-term 200-day SMA (bearish) but holding above the rising 50-day SMA (bullish). The conflicting moving averages suggest a lack of a decided long-term trend.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:10:43.918Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $2,075.00 | $2,070.00 - $2,080.00 | Strong | Confluence of the rising 50-day SMA (2,073) and recent consolidation support. |

| $2,010.00 | $2,000.00 - $2,020.00 | Strong | Lower Bollinger Band area and psychological support level tested multiple times recently. |

| $1,970.00 | $1,960.00 - $1,980.00 | Weak | Swing lows from early 2026. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $2,155.00 | $2,150.00 - $2,160.00 | Weak | Immediate resistance at the 20-day SMA (2,151) and recent daily highs. |

| $2,290.00 | $2,280.00 - $2,300.00 | Strong | Major resistance confluence: Upper Bollinger Band, 200-day SMA (2,283), and recent swing highs. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Weak | Symmetrical Triangle / Consolidation | Neutral | N/A | Price action is compressing with slightly lower highs and higher lows, indicated by the squeezing Bollinger Bands. |

| Weak | Moving Average Squeeze | Neutral | N/A | The price is trapped between the 50-day SMA (support) and 20-day/200-day SMAs (resistance), often preceding a volatility expansion. |

Frequently Asked Questions about MELI

What is the current sentiment for MELI?

The short-term sentiment for MELI is currently Neutral because Price is consolidating sideways with RSI at 51 (midpoint) and MACD virtually flat, showing no clear directional momentum. The price is currently stuck between the 20-day SMA resistance and 50-day SMA support.. The long-term trend is classified as Neutral.

What are the key support levels for MELI?

StockDips.AI has identified key support levels for MELI at $2,075.00 and $2,010.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is MELI in a significant dip or a Value Dip right now?

MELI has a Value Score of 98/100. It is currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.