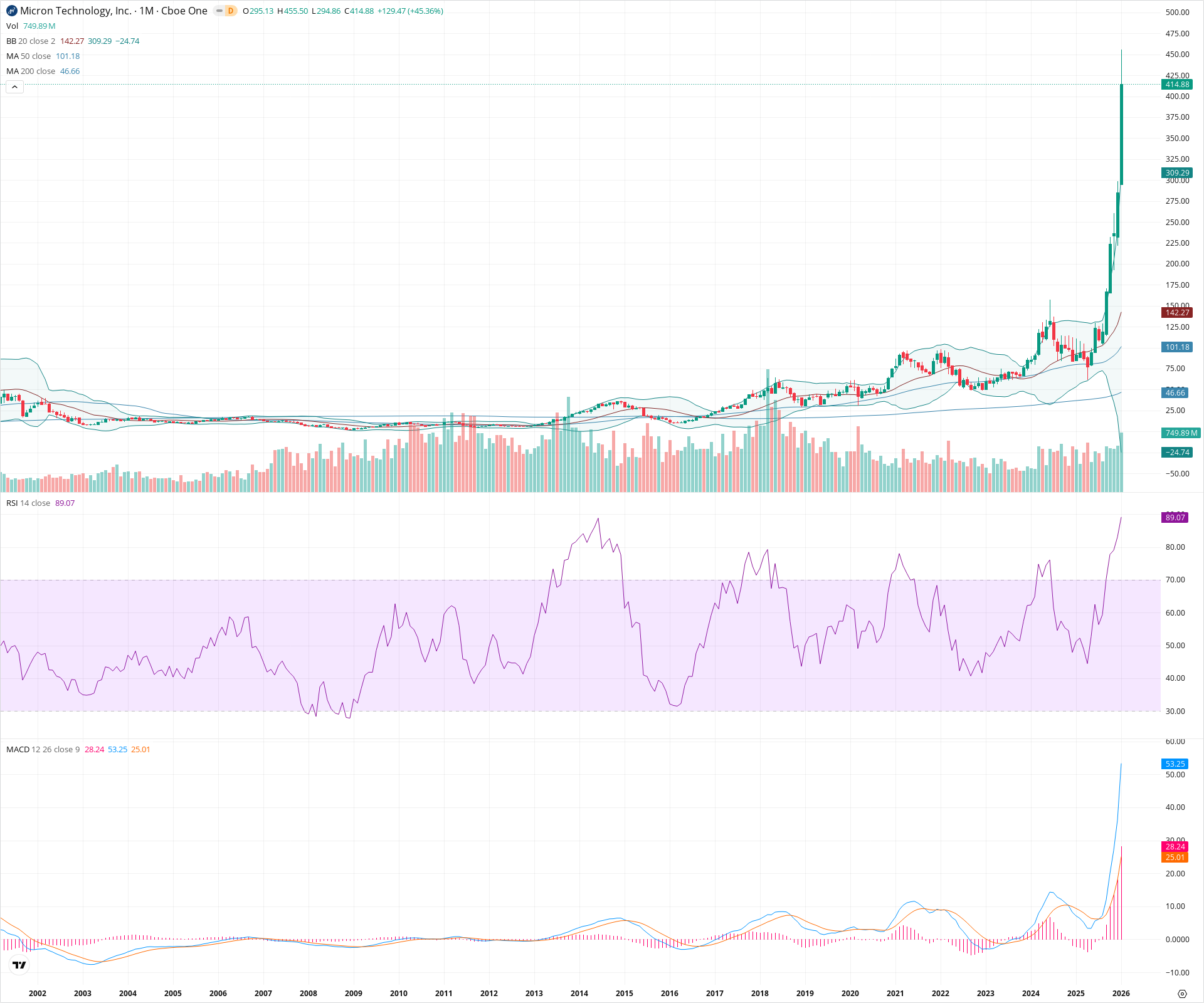

MU Monthly Technical Analysis

Micron Technology Inc

American producer of computer memory and data storage solutions, including DRAM (dynamic random-access memory) and NAND flash memory products. Their products are essential for a wide range of applications, from personal computers and mobile devices to data centers and automotive systems.

MU Technical Analysis Summary

Micron Technology is experiencing a historic parabolic run, breaking into price discovery with extreme momentum, evidenced by an RSI near 90 and price far exceeding the upper Bollinger Band. While the long-term structural trend is powerfully bullish following the breakout from the 100-150 base, the vertical nature of the recent move suggests elevated volatility and an extended condition. Investors are seeing a strong secular bull regime, though the distance from mean support levels (50 SMA at ~101) indicates a highly aggressive risk environment.

Included In Lists

Related Tickers of Interest

MU Monthly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is in a vertical parabolic discovery phase, trading near the top of a massive +45% monthly candle with expanding volume and MACD divergence.

Long-term Sentiment (weeks to months): Bullish

The stock has confirmed a multi-decade breakout above all historical resistance, supported by a widening positive MACD and trending moving averages.

Report Metadata

- Timeframe: monthly

- Generated at: 2026-02-02T06:46:36.111Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $297.00 | $294.00 - $300.00 | Weak | Current month's low and psychological round number; immediate support in a vertical trend. |

| $155.00 | $150.00 - $160.00 | Strong | Former all-time high and breakout zone prior to the current parabolic extension. |

| $100.00 | $95.00 - $105.00 | Strong | Major structural base and breakout level from the 2022-2023 consolidation period. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $455.50 | $455.50 - $455.50 | Weak | Current all-time high achieved during the current active monthly candle. |

| $500.00 | $500.00 - $500.00 | Strong | Major psychological level and potential extension target. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Parabolic Breakout | Bullish | N/A | Price has gone vertical, detaching significantly from moving averages and upper Bollinger Bands. |

| Strong | Multi-Year Base Breakout | Bullish | N/A | Successful breakout from a long-term consolidation zone (approx. 2018-2023) above the 100 level. |

Frequently Asked Questions about MU

What is the current sentiment for MU?

The short-term sentiment for MU is currently Bullish because Price is in a vertical parabolic discovery phase, trading near the top of a massive +45% monthly candle with expanding volume and MACD divergence.. The long-term trend is classified as Bullish.

What are the key support levels for MU?

StockDips.AI has identified key support levels for MU at $297.00 and $155.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is MU in a significant dip or a Value Dip right now?

MU has a Value Score of 55/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.