V Daily Technical Analysis

Visa

World’s leading digital payments network enabling global card transactions.

V Technical Analysis Summary

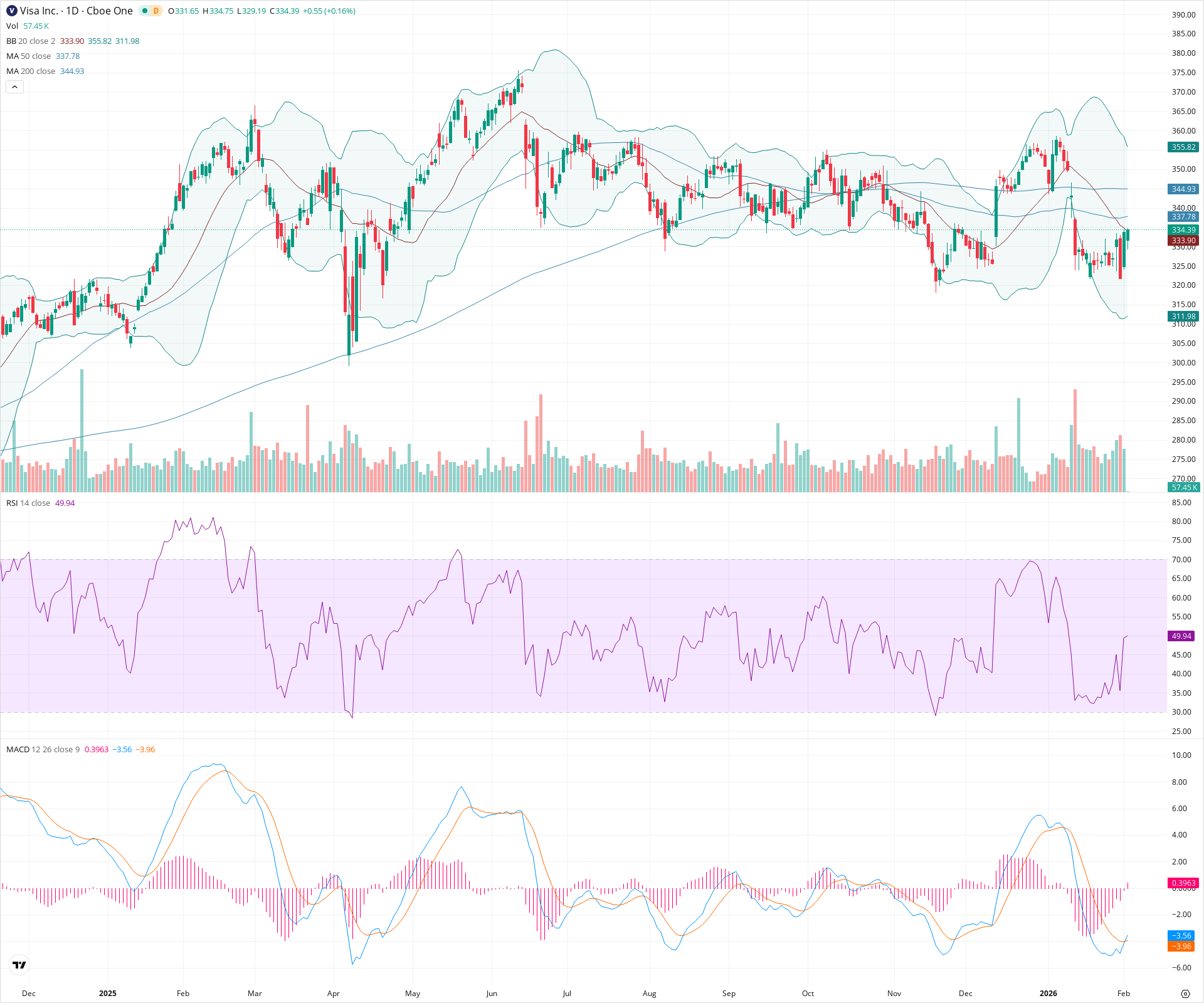

Visa Inc. remains in a technically bearish posture on the daily timeframe, evidenced by price action residing below the 200-day and 50-day moving averages. While the MACD indicates a short-term momentum shift with a bullish crossover and the RSI has recovered to neutral, overhead resistance is dense between 337 and 345. A confirmed breakout above the 200-day SMA is required to shift the long-term bias, otherwise the trend favors retesting lower supports.

Included In Lists

Related Tickers of Interest

V Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

Price is consolidating around the Bollinger Band basis line and RSI is effectively neutral at 49.94. While a recent MACD bullish crossover suggests improving momentum, the price remains capped by the descending 50-day SMA.

Long-term Sentiment (weeks to months): Bearish

The stock is trading below both the 50-day and 200-day Simple Moving Averages. The 50-day SMA is below the 200-day SMA (Death Cross structure), indicating a dominant downtrend on the higher timeframe.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:05:18.119Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $327.00 | $325.00 - $329.00 | Weak | Immediate consolidation floor and recent short-term lows. |

| $311.00 | $310.00 - $312.00 | Strong | Recent significant swing low established in January. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $337.50 | $337.00 - $338.00 | Strong | Confluence of the 50-day SMA and recent price rejection areas. |

| $345.50 | $345.00 - $346.00 | Strong | The 200-day SMA acts as major structural resistance. |

| $355.50 | $355.00 - $356.00 | Weak | Upper Bollinger Band and previous minor swing highs. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Death Cross | Bearish | N/A | The 50-day SMA is positioned below the 200-day SMA, signaling a prevailing bearish trend. |

| Strong | Bearish Channel / Downtrend | Bearish | $310.00 | Price action since late 2025 has formed lower highs and lower lows, consistently respecting the moving averages as dynamic resistance. |

Frequently Asked Questions about V

What is the current sentiment for V?

The short-term sentiment for V is currently Neutral because Price is consolidating around the Bollinger Band basis line and RSI is effectively neutral at 49.94. While a recent MACD bullish crossover suggests improving momentum, the price remains capped by the descending 50-day SMA.. The long-term trend is classified as Bearish.

What are the key support levels for V?

StockDips.AI has identified key support levels for V at $327.00 and $311.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is V in a significant dip or a Value Dip right now?

V has a Value Score of 58/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.