MA Daily Technical Analysis

Mastercard Inc

A global financial services company that provides a wide range of payment choices and processes transactions for credit and debit cards, electronic cash, and ATMs.

MA Technical Analysis Summary

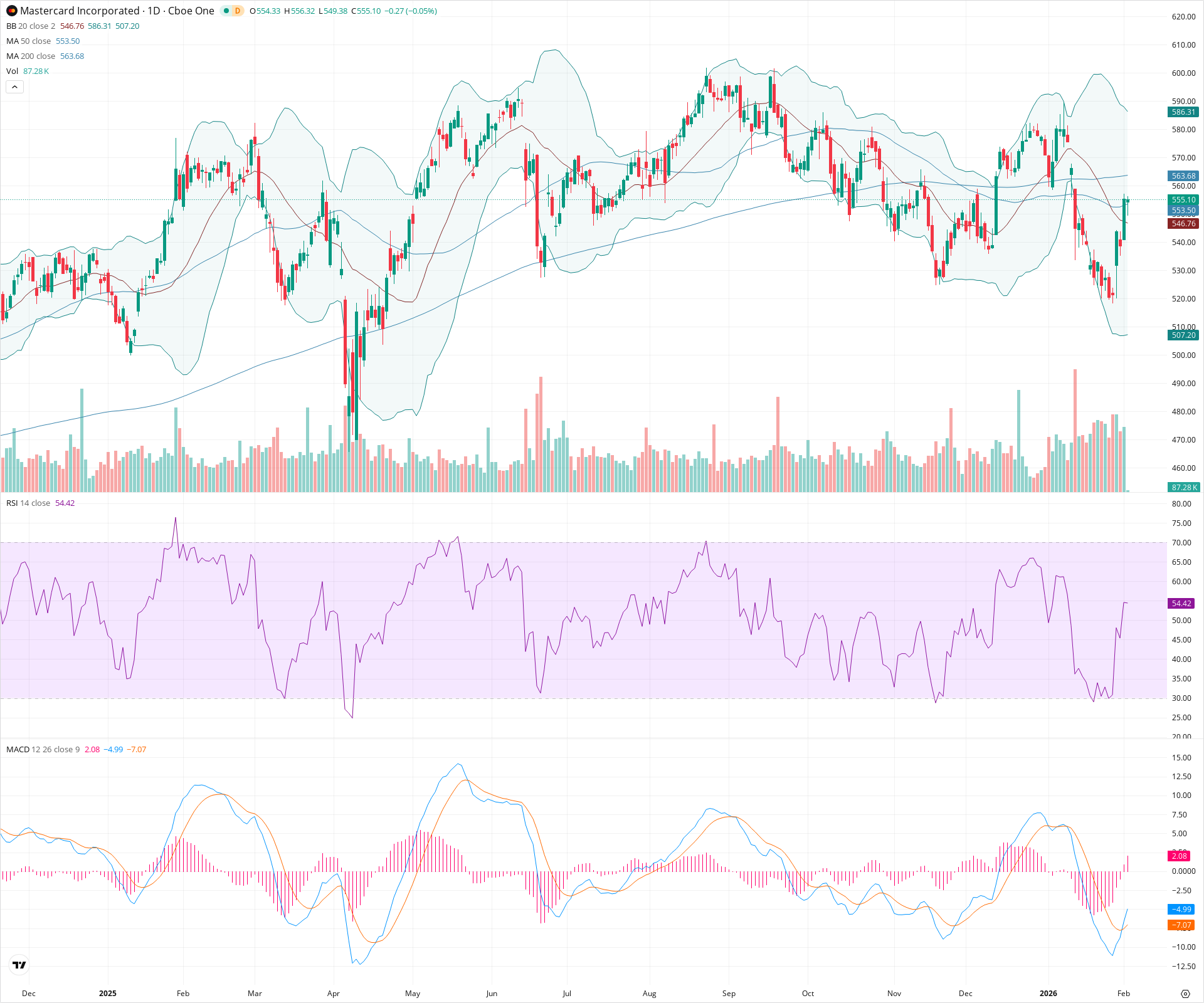

Mastercard (MA) is currently in a relief rally, having bounced off the 507 level to trade back above its 50-day moving average. Short-term signals are positive with a bullish MACD crossover and rising RSI, suggesting immediate buying interest. However, the long-term trend remains cautious as the price faces critical resistance at the 200-day SMA near 564; a failure to break this level could see the stock resume its broader corrective trend.

Included In Lists

Related Tickers of Interest

MA Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price has staged a strong recovery from recent lows at 507, reclaiming the 50-day SMA. Momentum indicators like the MACD have crossed bullishly, and the RSI is rising.

Long-term Sentiment (weeks to months): Neutral

Despite the recent bounce, the stock remains below the technically significant 200-day SMA and has not yet broken the sequence of lower highs established from the peak.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-03T15:05:50.918Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $553.25 | $553.00 - $553.50 | Weak | Immediate support provided by the 50-day SMA, which price recently reclaimed. |

| $508.50 | $507.00 - $510.00 | Strong | Major swing low and coincidence with the Lower Bollinger Band. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $563.50 | $563.00 - $564.00 | Strong | The 200-day SMA is the primary overhead resistance barrier. |

| $588.00 | $586.00 - $590.00 | Moderate | Upper Bollinger Band and previous consolidation peaks. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Moderate | Bullish MACD Crossover | Bullish | N/A | The MACD line has crossed above the signal line while in negative territory, confirming a shift in short-term momentum to the upside. |

| Strong | Correction Channel | Bearish | N/A | A broader downtrend channel defined by lower highs and lower lows since the chart's peak. |

Frequently Asked Questions about MA

What is the current sentiment for MA?

The short-term sentiment for MA is currently Bullish because Price has staged a strong recovery from recent lows at 507, reclaiming the 50-day SMA. Momentum indicators like the MACD have crossed bullishly, and the RSI is rising.. The long-term trend is classified as Neutral.

What are the key support levels for MA?

StockDips.AI has identified key support levels for MA at $553.25 and $508.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is MA in a significant dip or a Value Dip right now?

MA has a Value Score of 68/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.