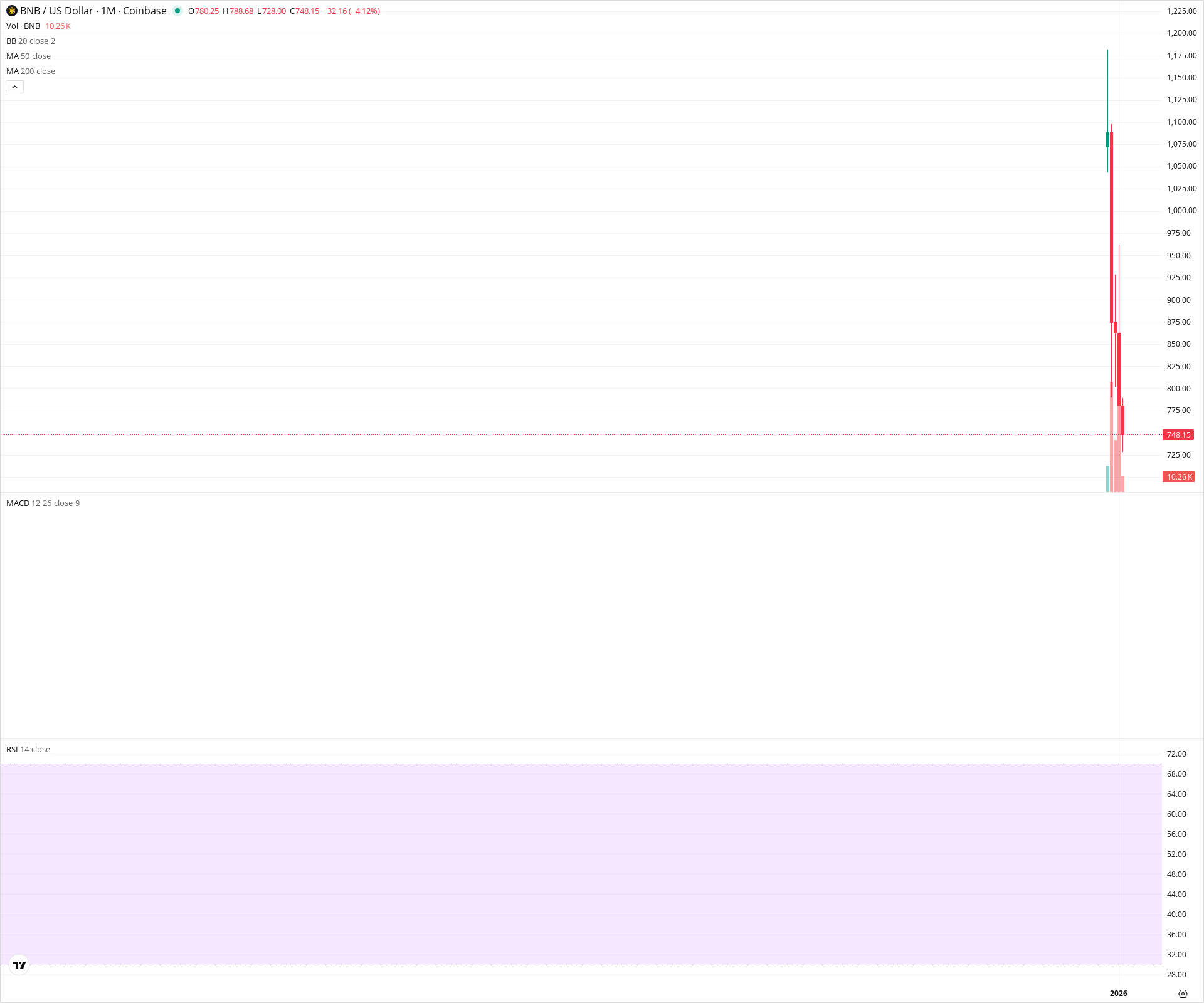

BNB Monthly Technical Analysis

Binance Coin

Utility token of the Binance ecosystem, used for transaction fees and blockchain operations.

BNB Technical Analysis Summary

BNB is exhibiting extreme volatility characteristic of a new price discovery phase or a recent listing on this specific feed, with insufficient historical data to populate standard indicators like MACD or RSI. The price action is dominated by a massive bullish impulse to highs near 1,075, followed by a steep correction currently testing the 748 level. While the long-term bias remains structurally bullish due to the magnitude of the breakout, the immediate outlook is defensive as the market seeks a support floor after the rapid ascent.

Included In Lists

Related Tickers of Interest

BNB Monthly Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

The price is in a sharp correction phase, currently down over 4% for the month after rejecting from highs near 1,075. The formation of a red candle following a volatility spike indicates immediate profit-taking.

Long-term Sentiment (weeks to months): Bullish

Despite the current pullback, the visible market structure shows a massive parabolic breakout impulse. The asset is likely in a price discovery phase, with the prevailing major trend being upward.

Report Metadata

- Timeframe: monthly

- Generated at: 2026-02-02T07:18:39.910Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $727.50 | $725.00 - $730.00 | Weak | Immediate support defined by the current monthly low (728.00). |

| $600.00 | $580.00 - $620.00 | Strong | Estimated base of the major bullish impulse candle where the vertical move initiated. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $785.00 | $780.00 - $790.00 | Weak | Current monthly opening price acting as immediate resistance to recovery. |

| $1,075.00 | $1,070.00 - $1,080.00 | Strong | The visible all-time high and rejection point (approx. 1,075). |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Parabolic Spike and Correction | Bearish | N/A | A massive vertical appreciation in price followed by a sharp pullback, typical of a 'blow-off top' or volatile price discovery phase. |

Frequently Asked Questions about BNB

What is the current sentiment for BNB?

The short-term sentiment for BNB is currently Bearish because The price is in a sharp correction phase, currently down over 4% for the month after rejecting from highs near 1,075. The formation of a red candle following a volatility spike indicates immediate profit-taking.. The long-term trend is classified as Bullish.

What are the key support levels for BNB?

StockDips.AI has identified key support levels for BNB at $727.50 and $600.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is BNB in a significant dip or a Value Dip right now?

BNB has a Value Score of 123/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.